- QIB’s SME gross revenue increased by 4.44%

- QIB created a B2B online community platform

- The bank introduced a series of new digital cash management solutions for SMEs

- The bank launched a new integrated host-to-host online payment management solution

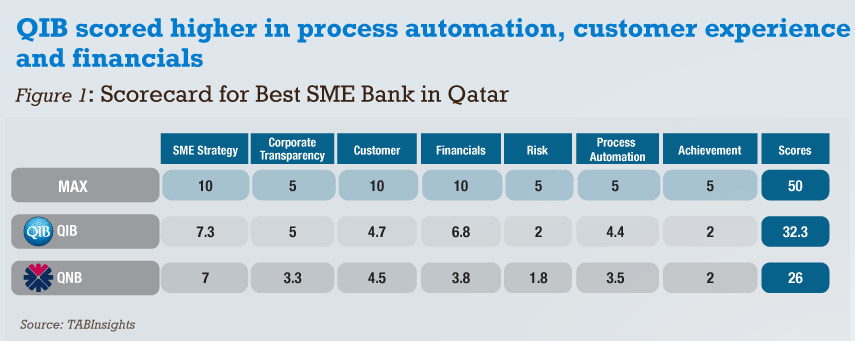

Singapore, 26 May 2022 – Qatar Islamic Bank (QIB), one of the largest commercial banks in Qatar was recognised as the Best SME Bank in Qatar at the Excellence in Retail Financial Services International Programme 2022 presented by The Asian Banker.

Financial Performance: QIB’s SME gross revenue increased by 4.44%

QIB’s gross revenue generated from the small and medium enterprises (SME) business grew by 4.44% from $43.39 million in 2020 to $45.33 million in 2021. The bank commanded a steady fee income in the SME business of 44% of the total SME revenue for the years 2020 and 2021. The SME business saw an increase in its net interest margin (NIM) from 5.42% in 2020 to 5.46% in 2021 due to the fall in the non-performing assets (NPA). In terms of QIB’s return on assets (ROA) in the SME business, the bank retained a constant ROA of 8% both in 2020 and 2021. QIB’s overall gross non-performing loan (NPL) ratio in the SME business reached 1% in 2020 and was further decreased to 0.92% in 2021.

Qatar National Bank (QNB), meanwhile, decreased its non-performing loans by 43%, from $767 million in 2019 to $435 million in 2021 due to the high-quality lending portfolio. Moreover, QNB’s loan portfolio to SMEs and microenterprises reached $6.29 billion in 2021.

Customer experience: Creating a B2B online community platform

QIB has been enhancing its corporate online and mobile banking systems to cater to the needs of its clients. As part of the initiatives, QIB integrated the government’s “Dhareeba” tax payment in its mobile app and corporate internet banking portal where corporate customers can pay for tax invoices in their accounts. Moreover, the number of SME customers increased by 8.55% from 19,300 customers in 2020 to 20,950 customers in 2021.

QNB, meanwhile, supported the SME sector by engaging with government programmes such as the National Response Programme in Qatar, thus offering further relief to businesses impacted by COVID-19. QNB helped customers to maintain their cash flow balance and liquidity under the difficult market environment by immediately rescheduling loan repayments and processing and new loan requests. The number of Qatari SME clients using QNB’s e-commerce platform surged to 250.

Process automation: Introducing a series of new digital cash management solutions for SMEs

QIB digitised the end-to-end SME financing customer journey. The bank introduced a series of new digital cash management solutions for SMEs, such as the digital host-to-host (H2H) online payment management solution, the remote deposit capture (RDC) service and the new corporate deposit-only card. The key objectives were to drive operational efficiency, improve customer experience, attract digitally savvy client, increase customer acquisition, and improve the cross-selling ratios. The SME financing process turnaround time (TAT) shrank by 50%; the standard tickets TAT shrank from 20 to 10 days, micro tickets TAT shrunk from 10 to 5 days, which resulted in relationship managers’ capacity freed by 20% due to the reduced processing time.

Key achievement: Launching a new integrated H2H online payment management solution

QIB launched a new integrated H2H online payment management solution for its corporate customers, in line with its endeavour to automate and accelerate the payment management experience of its corporate clients. QIB is the first Islamic bank to allow corporate customers to submit their payments from their ERP systems automatically without manual intervention. The H2H online payment system offers an extra layer of security and allows corporate customers to keep track of their transactions 24/7. The H2H solution will reduce the business efforts by at least 50% when processing bulk payments. It is an encrypted system between the corporates’ own ERP System and QIB corporate internet banking to process payments without manual intervention.

QNB, meanwhile, continued to enhance the range of digital services offered to customers. The bank’s e-commerce platform “QNB Simplify” helps small businesses showcase their products and services online. This year, QNB saw an increase in e-commerce volume by 29%.

About The Asian Banker

The Asian Banker is the region’s most authoritative provider of strategic business intelligence to the financial services community. The global research company has offices in Singapore, Malaysia, Manila, Hong Kong, Beijing, and Dubai, as well as representatives in London, New York, and San Francisco. It has a business model that revolves around three core business lines: publications, research services and forums. Visit the company website at www.theasianbanker.com

You may visit the Excellence in Retail Financial Services page at http://awards.asianbankerforums.com/retailfinancial/

To view the respective evaluation criteria, click here: https://awards.asianbankerforums.com/retailfinancial/criteria-country

For further information on the collaterals for winning banks, please contact:

Christian Kapfer

Research Director

M: (+63) 94 3283 6015

ckapfer@theasianbanker.com

All Comments