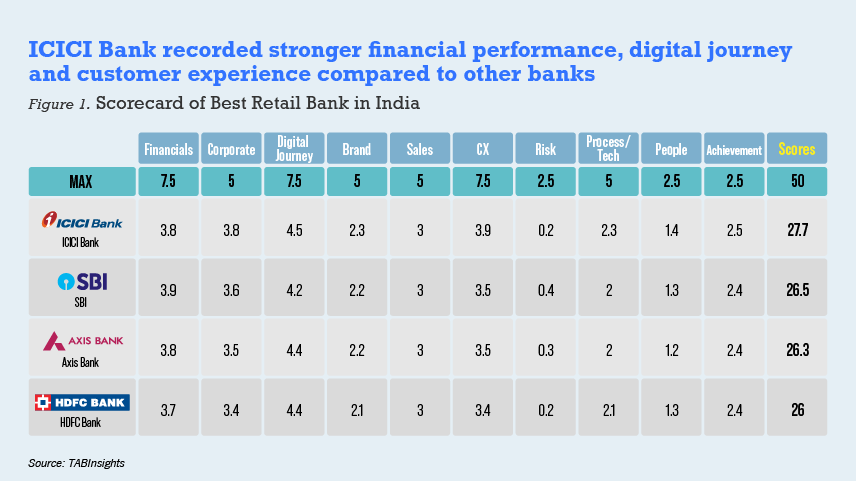

Financials: ICICI Bank recorded stronger retail banking performance compared to peers

In 2021, ICICI Bank’s profit grew by 16.9% to reach INR 313.51 billion ($4.01 billion). This growth is driven by the bank’s focused pursuit of market segments. In addition, the bank’s continuous efforts to strengthen its deposit business led to an increase of 20.3% in its total balance. This growth is laso driven reinforcing its digital platforms and process simplification to offer a more seamless banking experience to customers. ICICI Bank also recorded a significant improvement in return on equity (ROE) of 12.21%, compared to the previous year’s 7.07%. It also lowered its cost-to-income ratio (CIR) significantly to 37.20% from 43.50% in the previous year.

In comparison, the State Bank of India (SBI) recorded a slower increase in profit of 5%. Return on equity (ROE) stood at 12.51% and CIR stood at a higher 52.46%, a modest improvement from 53.60% a year ago. Meanwhile, Axis Bank’s profit increased by 10%. Its CIR was an impressive 28% while ROE was a more modest 7.19%. HDFC’s profit grew by 18.5%. It has a CIR of 36.3% compared to last year’s 38.6%.

Digital Journey: ICICI Bank recorded 150% increase in number of iMobile Pay transaction

ICICI Bank offers customers a seamless payment experience via iMobile Pay. The mobile payment application allows users to transfer funds to linked accounts with a single unified payment interface (UPI) ID. Non-ICBICI Bank customers can also use iMobile Pay to initiate such transactions, creating a new level of convenience and ease for them to pay or transfer funds between banks. ICICI Bank also introduced a ‘tap to pay’ feature which allows users to make payment from debit and credit cards directly through near field communication (NFC) by tapping their phone on point of sale (POS) terminals.

The number of iMobile Pay transactions increased 1.5 times in the fourth quarter ended on 31 December 2021, over the previous quarter. It also saw an increase of customer enquiries for other bank products such as mortgages, personal loans, credit cards, auto loans, National Pension Scheme, and provident fund accounts from non-ICICI Bank customers.

More significantly, the iMobile Pay application was downloaded and activated over 6.3 million times by non-ICICI Bank customers by the end-December 2021. The value of transactions by non-ICICI Bank customers increased by 73% over the previous year, against the total value of transactions that reached $61.3 billion (INR 4,55,326 crore) an increase of 50% year-on-year (YoY).

ICICI Bank increased its share value of electronic toll collections through FASTag to 39% in the third quarter of 2021 42% YoY growth. It was also able to leverage its greater share of UPI transactions to introduce more value-added services such as buy now, pay later (BNPL) to increase its fee income.

In 2021, ICICI Bank developed a comprehensive digital banking platform “ICICI STACK” that offers around 500 services to ensure seamless banking experience to retail, business banking, small ans medium enterprise (SME) and corporate customers. These services are available on the bank’s mobile banking platforms such as iMobile and InstaBIZ as well as its internet banking platform.

ICICI Bank has demonstrated strength in its digital capabilities. In comparison, Axis Bank has a market share of 17% for UPI and 16% for mobile. In 2021, it recorded over 160 million UPI-transactions in India.

Customer Experience: ICICI Bank enhanced their digital engagement with customers through various channels

To enhance customer service and experience, ICICI Bank partners with fintech companies to leverage technology and analytics for deeper insights into customer needs and behaviours.

In 2021, ICICI bank introduced a video-based know-your-customer process (video KYC) to allow customers to complete their onboarding process through a contactless video interaction. As a result, over 1.6 million video KYCs were completed by end of December 2021. In addition, a virtual relationship management channel was introduced to manage customers’ transaction and product needs through a human interface via a phone.

ICICI Bank whatsapp banking enabled customers to manage multiple banking services, from issuing a cheque book to setting up credit card auto-debit. It is also available for customers to check bank balance, find nearby automated teller machines (ATMs), check status of pre-approved loans and FASTag transactions. By the end of the year, three million customers were actively using these services.

During the year, ICICI Bank also launched iPal Chatbot to offer even better interaction on its banking website, through text, video, image, and voice. Through artificial intelligence (AI) and machine learning (ML), iPal Chatbot can offer and deliver highly personalised products based on customer responses. ICICI Bank saw a 13% increase in ICICIBank.com website users as a result. The bank's chatbot saw a significant growth in the last five years from a monthly volume of around 0.40 million in 2017 to 3.5 million a month in 2021.

On the other hand, SBI launched Doorstep Banking, which provides customers access to services such as account statement, cash withdrawal, life certificate submission (for pensioners) etc. The bank also re-introduced traditional floor managers across its more than 2,400 branches to enhance customer service experience. Meanwhile, Axis Bank launched AI driven KYC verification to improve process accuracy, efficiency and turnaround for different operations, including account opening.

This is a co-published article and does not necessarily reflect the opinion of the publisher.

All Comments