In today’s fast-paced financial landscape, technology is not just an enabler but a fundamental driver of success. From online banking to mobile payments, the digital transformation of banking services has revolutionised how customers interact with financial institutions. Yet, despite the undeniable importance of technology, many banking boards remain ill-equipped to navigate this technological terrain.

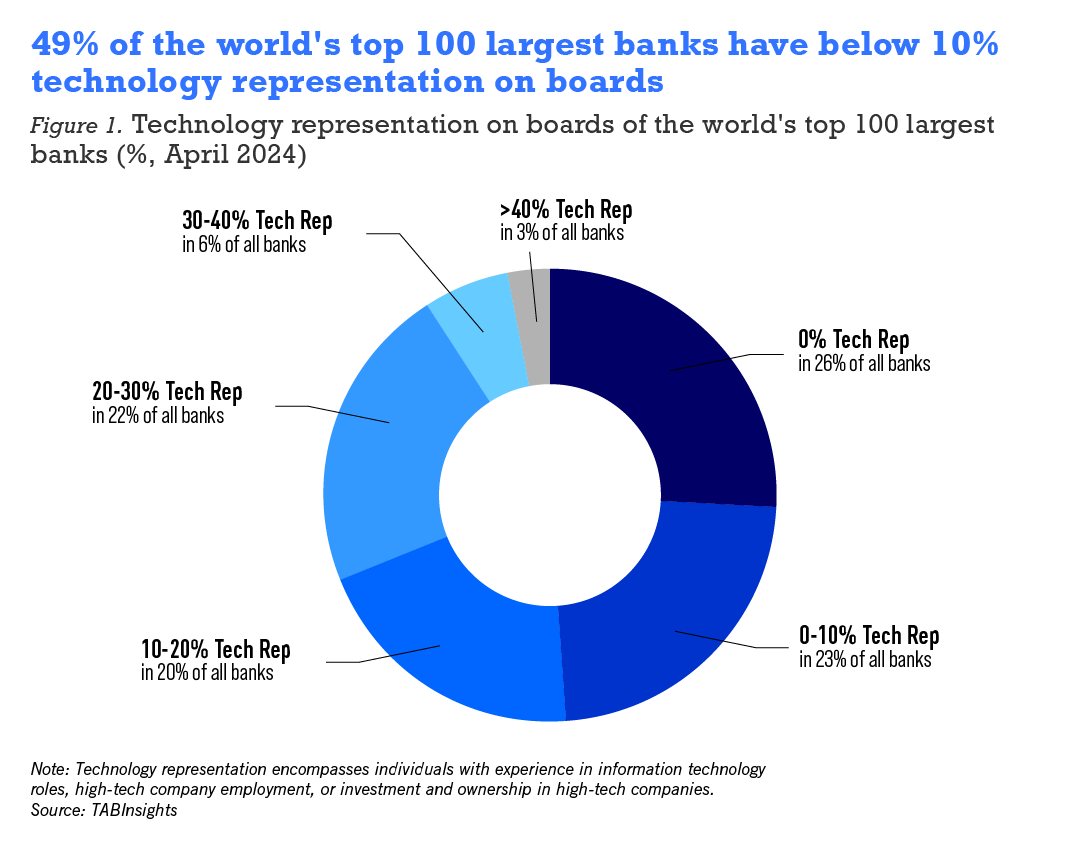

According to research by The Asian Banker’s research arm, TABInsights, a significant proportion of banking boards lack members with substantial technology expertise. Among the world’s top 100 largest banks, 26 banks have no technology representation on the boards, while an additional 23 banks have less than 10% technology representation. On average, technology representation on the boards of these 100 banks stands at 13.5%.

This deficiency is concerning, given that decisions made at the board level profoundly impact a bank’s technological trajectory. Without adequate representation and understanding of technology, boards may fail to grasp the urgency of investing in modernising infrastructure.

TABInsights highlights the pervasive lack of investment appetite among banking boards to future-proof technology infrastructure. As banks grapple with legacy systems, technical debt, and the threat of technology obsolescence, the reluctance to allocate resources towards technological advancement puts them at a severe disadvantage.

Furthermore, many incumbent banks still rely on core banking systems that sit on decades-old mainframe computers, based on defunct programming languages, while their new economy counterparts operate businesses from the latest graphics processing units that require no conventional coding. This technology gap places traditional banks at a significant disadvantage in terms of agility, scalability, and the ability to harness data for insights and decision-making.

Additionally, the increasing occurrence of system failures and breakdowns underscores the urgency of addressing technological deficiencies. Decrepit systems that can no longer be scaled or serviced lead to disruptions in banking services, eroding customer trust and damaging the bank’s reputation. The crunch time for replacement has arguably already passed, as evidenced by the rising frequency of disruptions in recent years.

The consequences of this oversight are dire. Outdated technology not only impedes innovation but also exposes banks to increased cybersecurity risks and operational inefficiencies. Moreover, in an era where customer expectations are continuously evolving, banks that fail to keep pace with technological advancements risk losing relevance in the market.

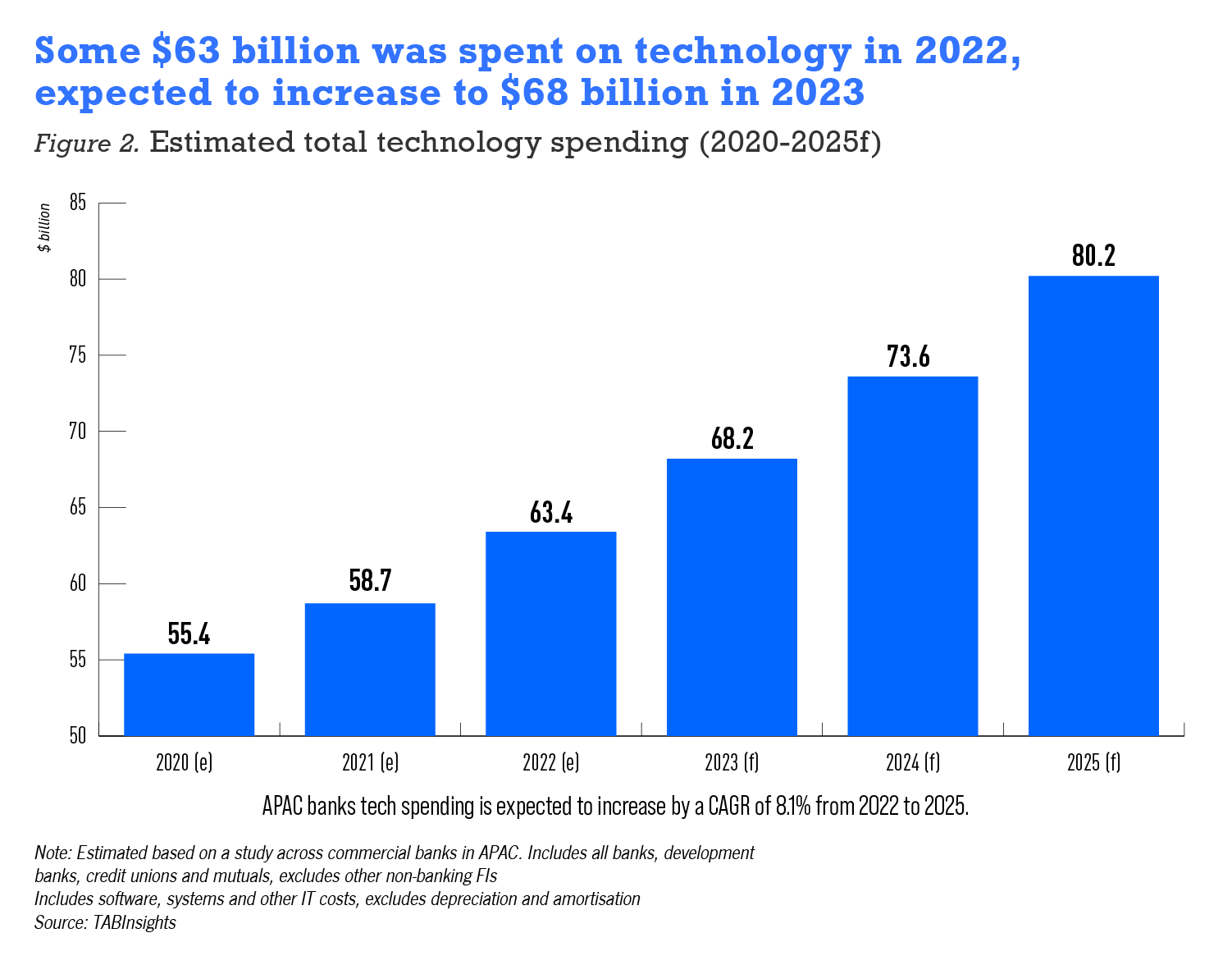

While overall technology spending in banks has risen from $55.4 billion to over $68 billion between 2020 and 2023 in Asia Pacific, according to TABinsights, most of it goes into running and maintaining existing legacy infrastructure, including risk and compliance, rather than ‘change-the-bank’ initiatives. On average, banks in Australia and Singapore have seen the highest technology spend-to-total income, with the highest individual banks spending between 8% and 10%.

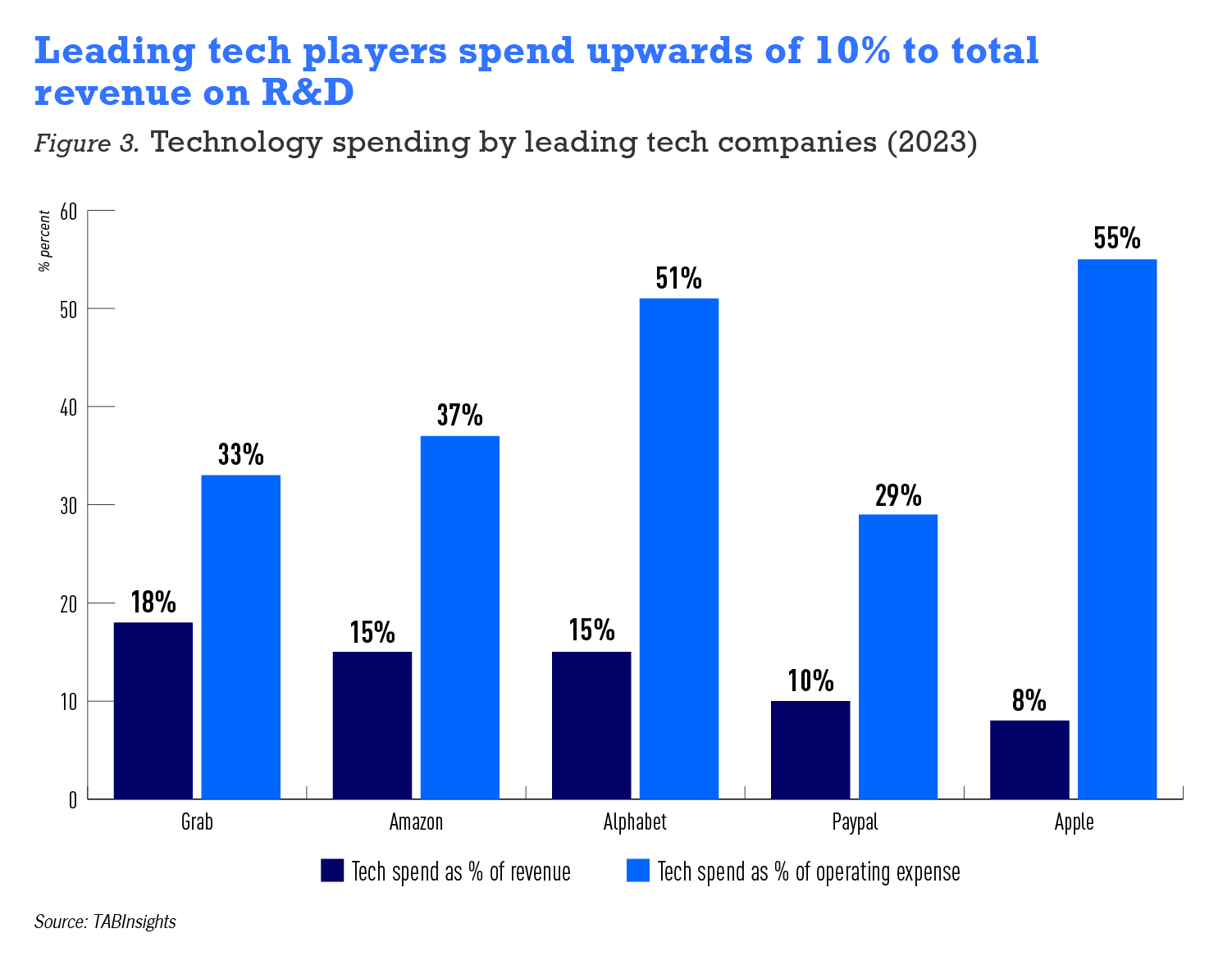

In contrast, though not fully comparable, leading fintech, telco and technology companies invest a bigger portion, upwards of 10% of income, towards research and development and technology.

To address these challenges, banking boards must prioritise technology expertise in their governance. By appointing members with a deep understanding of technology trends and their implications for the industry, boards can make more informed decisions regarding technology investments and strategic initiatives.

Furthermore, fostering a culture of innovation and agility within banks is essential for staying ahead in today’s digital age. Boards should encourage a mindset that embraces experimentation and adaptation to emerging technologies, rather than clinging to outdated practices.

Additionally, banking regulators play a crucial role in incentivising technology adoption, ensuring that banks prioritise investments in technological infrastructure. Regulatory frameworks should encourage banks to allocate resources towards modernisation efforts and penalise those that neglect to do so.

The lack of understanding and investment appetite for technology among banking boards pose a significant threat to the industry’s future. To remain competitive and resilient in the digital era, banks must recognise the critical role of technology and take proactive steps to address deficiencies at the board level. Only by embracing technology as a strategic imperative can banks future-proof their operations and deliver value to customers in a definitively digital world.

All Comments