- Banks turn up the heat on strategic partnerships with fintech players

- A multichannel approach to payments

- Instant payments and APIs as new game changers

As corporates demand more transparency and finality of their transactions, the definition of payments is undergoing a profound change from mere settlement and movement of funds to ‘payment proximate’ activities. These include investment decisions, trade and supply chain financing and risk mitigation, cross-border transfers of insurance claims, payroll, pensions, medical aid and disbursement. All these are set to infuse more technology into payment products. This translated to a marketplace getting extensively reshaped by interaction of traditional and new payment providers.

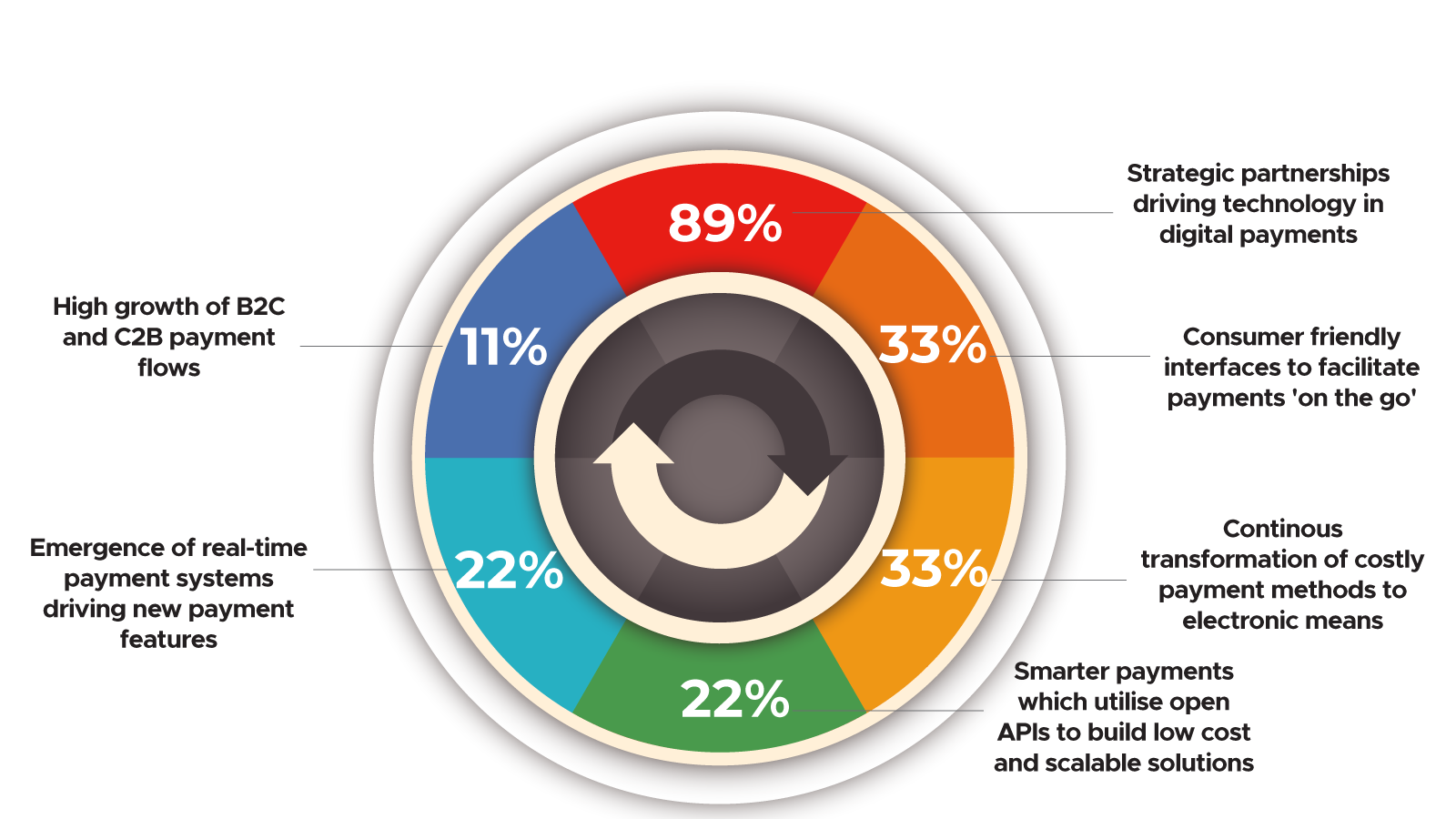

The latest Asian Banker survey of payment trends across Asia Pacific reveals that banks are getting more approving of strategic partnerships with payment fintechs. Through smarter collaboration, both parties are accelerating co-creation and innovation to solve customer problems as demonstrated by a whopping 89% of respondents exploring nontraditional alliances to drive digital payments, up from 20% last year.

The rise of e-commerce shaped by transformation in business-tobusiness (B2B) segment is accentuating the need for reconciliation and collection technologies as sellers are bypassing wholesalers to reach customers directly. Led by digital and cultural changes, the new ‘direct-toconsumer’ era is fuelling large volumes of small payments. Alternative payment methods such as e-wallets and mobile in particular has shown significant traction as 33% of respondents cite significance of consumer friendly interfaces while they ditch costly payment methods.

As discussed in the 2020/2021 Asian Banker cash management survey, adoption of application programming interfaces (APIs) continues to drive the treasury towards real-time. With growing demand for instant payments and confirmations, banks are heavily investing in solutions and platforms that will help clients transition seamlessly to a cashless ecosystem. The launch of real-time domestic systems and their future integration is expected to deliver the next revolution of Asia’s payment landscape. About 22% of respondents observed these trends and 33% of them highlighted access to round-the-clock payment channels as key best practice.

Partnerships with fintechs and adoption of multi-channel options to expedite payments were recognised as key themes

Figure 1. Emerging key themes in payments 2020/2021

Source: Asian Banker Research

Banks turn up the heat on strategic partnerships with fintech players

In pursuit of gaining access to new and agile state-of-the-art technologies and flexibility, more banks have opened up to embrace fintech partnerships.

Bank of China (BOC) partnered with China UnionPay to build a unified port for mobile integrated financial services where BOC’s cardholders will be able to use a quick response (QR) code to spend, transfer and trade on a cloud flash payment application. Hang Seng Bank stepped up product strategy initiatives with solution partners like Hreasily, XERO, SWIFT global payment initiative (gpi), and Tencent in areas of regional account opening and retail payments solutions.

With entry of emerging players bringing speed to payments, State Bank of India (SBI) expects digital payments to grow at a compounded annual growth rate of 52% over the next five years. It launched its omni-channel platform SBI YONO for both retail and business clients where it has partnered with fintechs to exploit next generation technologies and provide low cost and scalable solutions. Apart from wallets to API-based solutions, YES Bank has partnered with BOLERO to facilitate the electronic presentation of export documents which reduced the turnaround time from 10 days to real-time.

Significant growth of merchants of direct banks and small-volume overseas remittance companies is driving competition in digital remittance market in South Korea. Woori Bank completed the second successful trial of cross-border remittance in partnership with Ripple, which it aims to commercialise in the latter part of this year.

Bangkok Bank is the only Thai bank with the ability to send and receive funds transfers from post offices worldwide. It leverages partnership with Eurogiro network (a partner for cross-border payments) and other technology start-ups to process much higher volumes of digital transactions and gain market share in corporate payment networks.

Banks are eyeing payments as an infrastructure platform rather than as a standalone product service. Techcombank highlights infrastructure rationalisation as a key theme with payments intermediaries (including banks and fintechs) coming together to explore distributed ledger technology (DLT) to transform cross-border payments.

As one of the foremost supporters of SWIFT’s gpi service, Deutsche Bank utilises the gpi’s cloud technology to improve transparency and facilitate end-to-end tracking of payments to drive down costs and reduce the number of enquiries. The bank observes that the resulting modernisation will allow companies to optimise liquidity and explore innovative add-on services.

A multichannel approach to payments

In our last year’s survey on payment trends, we described how the shift to ‘anytime, anywhere’ demand from new-age consumers was complemented by the availability of mobile devices and nextgeneration non-physical interfaces. Moving forward a year into the new normal, such technologies with their rich functional capabilities are capable of enabling complex transactions with a simple click or touch. The industry continues to see the rollout of more efficient, easy-to-deploy and cost effective payment channels.

Given the wide geographical and demographical landscape in Indonesia, consumers prefer digital transactions via mobile banking, internet banking and other e-banking platforms rather than offline channels. For its institutional customers, UOB Indonesia utilises mobile banking, e-banking and host-to-host channels for real-time online single and bulk payment with multi-channels standardisation for them to reconcile easily.

With government of India’s digital push, SBI provided support to major commerce merchants and payment aggregators through the SBI payment gateway (PG), capable of processing one crore (10 million) transactions daily. The PG is integrated with all major e-commerce merchants and ate an omni-channel experience that enables personalised services across channels including mobile banking, ATMs, contact centre and website. A major logistics company in Thailand provided a payment solution to its customers with the convenience of paying via QR code using the mobile banking application of any bank. This is efficient and cost-saving for the logistics company which can automatically reconcile payments on a real-time basis and instantly make refunds or cancel payments.

Recognising the need for global payments to be highly modular, scalable and flexible, Deutsche Bank attests enough support should be provided to be able to support different countries’ legacy and regulatory requirements. In this respect, it rolled out Galileo, an integrated payments processing platform, which integrates the complete set of payment types including low-value, high-value, bulk, XML, SWIFT gpi, and instant payments.

There is a wider practice among financial institutions (FIs) to integrate different business lines to provide flexible foreign exchange (FX) and payment channels. Bank of America meets multiple operational needs of both FX execution and payments by combining resources and network of its global transaction services and global foreign exchange groups. Its CashPro® FX delivers execution and cross-currency payment capabilities in over 140 global currencies while fully integrating trading and payment activities by using CashPro Payments to settle FX deals. The payments can be wired to over 230 markers from start of business in Asia Pacific on Monday to end of business in the US on Friday.

Instant payments and APIs as new game changers

The launch of domestic instant payment schemes has been a significant game changer for corporates especially in the business-to-businessto-consumer (B2B2C) space. They provide real-time access to cash flow information especially with a view on their receivables statuses. A number of corporates have looked into API connectivity with their banking service providers in order to gain access to real-time services.

Hang Seng Bank developed a range of propositions such as direct debit instruction API and status enquiry API to enhance the advanced connection between customers’ enterprise resource planning (ERP) with the bank’s backend system or bill payment facilities via faster payment system (FPS) QR code to meet day-end bank statement reconciliation.

The launch of the immediate payment service (IMPS) in 2010, and unified payments interface (UPI) in 2016 is further driving the ubiquity of real-time payments in India. Leveraging UPI, Kotak Mahindra Bank operates a consumer-to-business (C2B) collections platform on the back of a biller operating unit. This drives inter-bank ability for consumers to call for bills, validate and make payments. Integrating with UPI, this becomes a powerful collection solution for its corporate customers.

Singapore-based banks launched relevant APIs that leverage PayNow Corporate, Singapore’s enhanced fund transfer service that links SGD Corporate Account to the institution’s unique entity number. OCBC Bank, for instance eliminates issuance of paper cheques with API to provide swift and easy disbursement of award monies to students. The interoperability between the bank and the partner corporate’s system through API triggers real-time payment instructions that eliminate reconciliation errors and bulk handling of cheques.

UOB Singapore facilitated instant payments and efficient cash-outs for drivers and merchants amid intensifying competition within the ride-hailing and e-wallet space in Southeast Asia. It enabled straightthrough processing via API connectivity and fast and secure transfers (FAST) clearing infrastructure to enhance the payout experience for drivers and merchants.

Bangkok Bank recognised the rise of open banking and the use of open APIs such that it allowed integration of payments services into third party and multi-bank solutions. For the bank, it aids in providing additional product features, and self-service data analytics as it makes its way as a ‘differentiator’ among otherwise ‘standard financial services offerings’ in Thailand.

As the global financial services industry comes to grips with digital payments, more product and infrastructure features are being enhanced and/or added, of which one draws more attention unlike any other. That is, the potential launch of central bank digital currencies (CBDCs) as central banks undertake extensive work on digital currencies to improve the cost, security, speed and reach of transactions to eventually accelerate the growth of cashless ecosystems. The pandemic serves as a catalyst for the shift to agile and accessible payment infrastructures putting CBDCs into sharper focus.

All Comments