- Tighter unsecured lending standards led to slower unsecured loan growth in Singapore from 2014 to 2016

- Cautious lending and competition from informal lenders have negatively affected unsecured loan growth in Thailand

- The growing use of digital technology helps banks reduce the turnaround times for unsecured loans

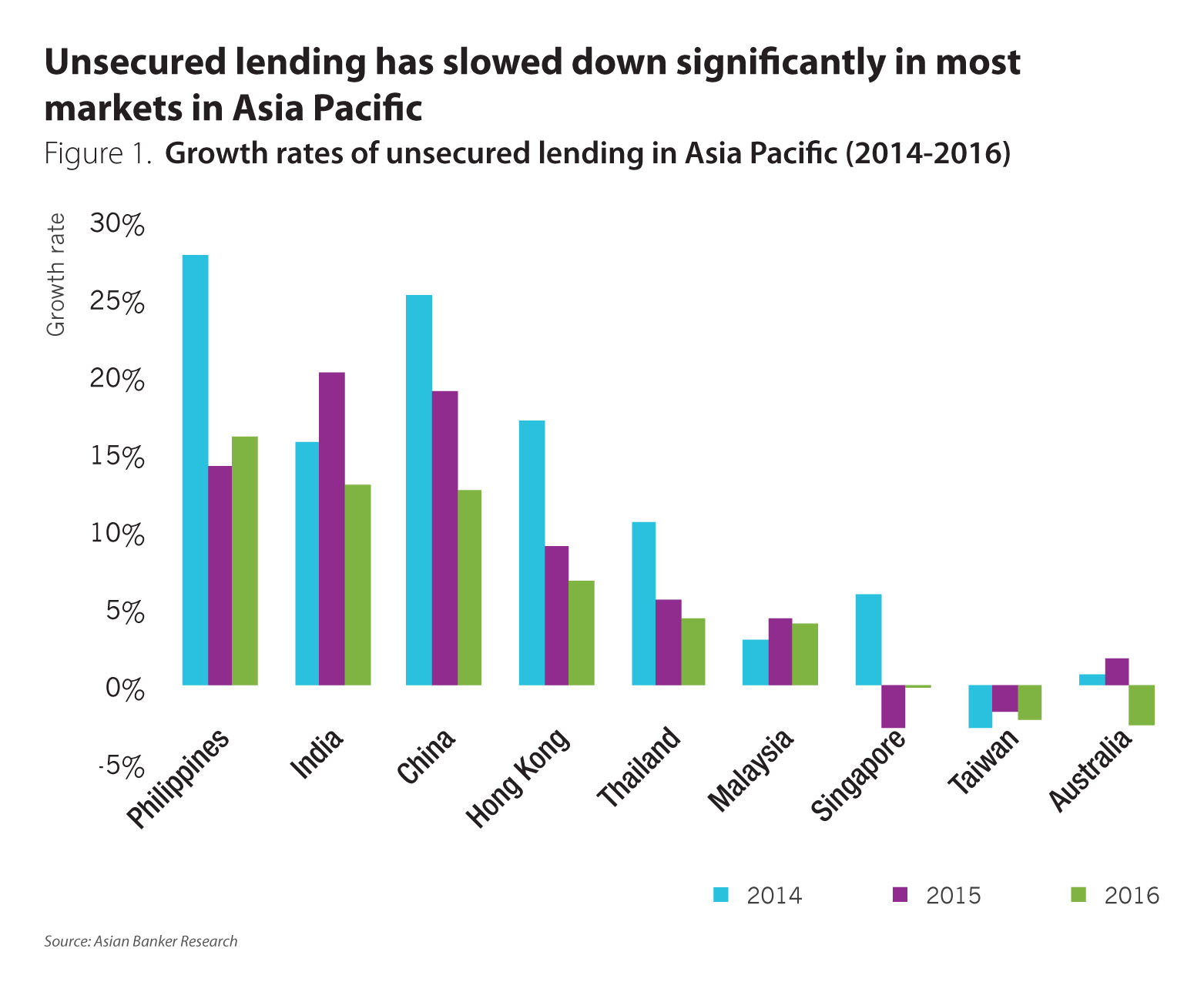

Asia Pacific’s banking industry has seen moderate unsecured lending growth. Commercial banks continue to face challenging economic and operating environment. In most markets, banks are required to adopt stricter unsecured loan standards, as they carry higher risks. In addition, the alternative lending options offered by nonbank lenders has also contributed to the deceleration of unsecured lending growth.

In 2016, the growth rates of bank unsecured loans in most Asia Pacific markets slowed down (Figure 1), with the share of bank unsecured lending in total retail lending also declining for most countries. Among the markets, only the Philippines and Singapore witnessed an improvement in unsecured lending growth rates in 2016. Particularly, the Philippines saw a rise of 16% in the bank unsecured loans in 2016, compared to 28% increase recorded in 2014 and 14% in 2015. Meanwhile, the growth of unsecured loans in Taiwan and Australia continued to plunge for the year.

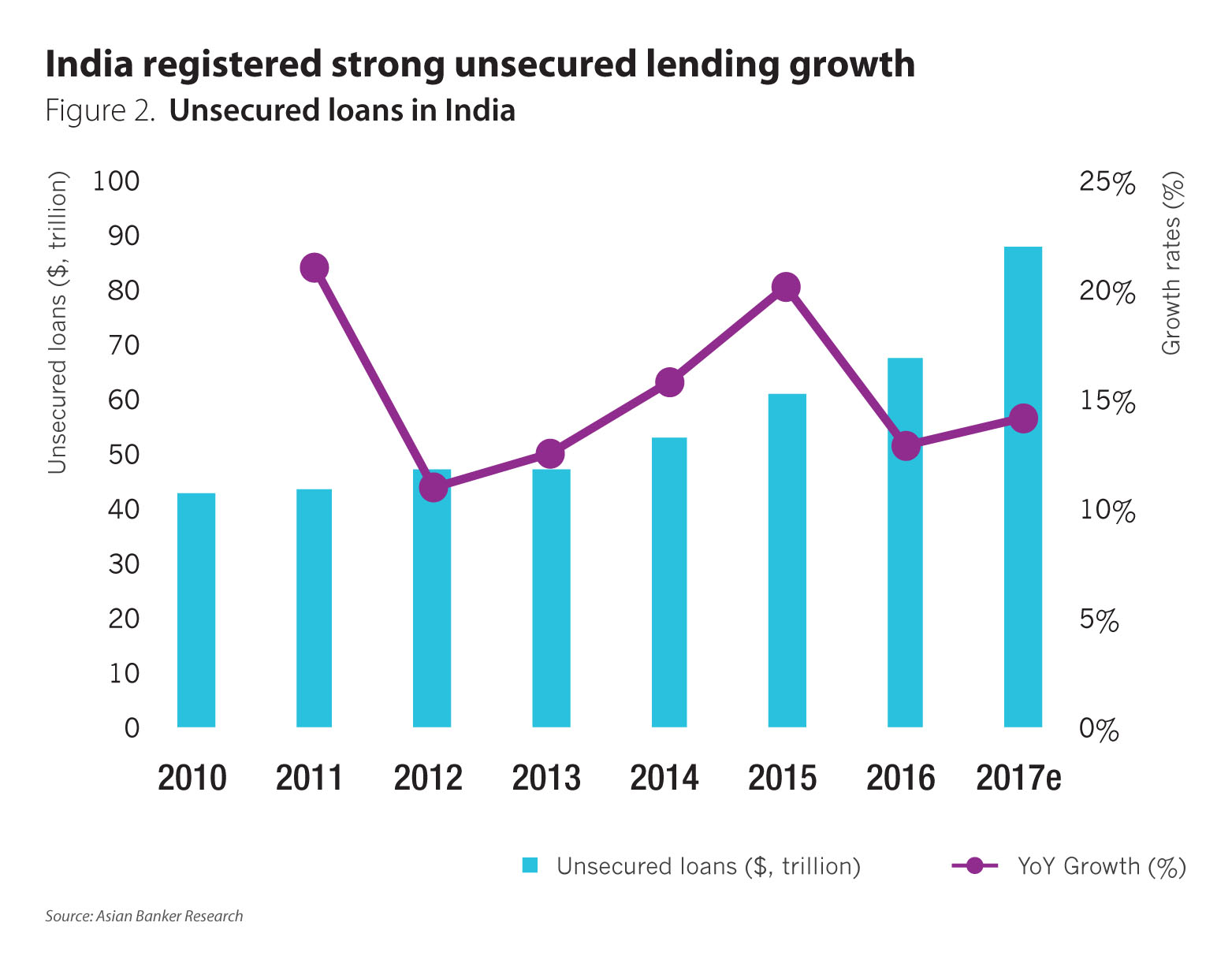

India

The unsecured lending in India’s banking sector expanded at the second fastest pace among these markets in 2016, although the growth slipped to 13% in 2016 from 16% in 2014 and 20% in 2015 (Figure 2). The growth slowed down considerably in November and December 2016, as India’s demonetisation resulted in a substantial reduction in the credit demand.

Indian banks have been aggressively pushing retail lending to improve the overall credit growth and maintain their profitability, as corporate loan growth was sluggish. Meanwhile, the low level of retail delinquencies and the cross-selling of loan also contributed to the expansion of unsecured lending. A large portion of unsecured loans are given by banks to their existing customers through cross-selling.

Credit card loans was the fastest growing category in retail lending in 2016. Credit card outstanding surged at a compound annual growth rate (CAGR) of 24.6% between 2013 and 2016, largely owing to the aggressive marketing and reward points offered on the credit cards and the growth of digital payments post demonetisation. Meanwhile, Indian consumers are increasingly willing to spend, especially those young urban Indians, which also drives the growth of credit cards and other types of unsecured lending.

There are concerns over a rise in consumer indebtedness in India, due to the strong growth in retail lending, especially credit cards. Although some Indian banks are cautious to expand the unsecured loans further, we expect that the unsecured lending in Indian banking sector is able to maintain the growth momentum in 2017.

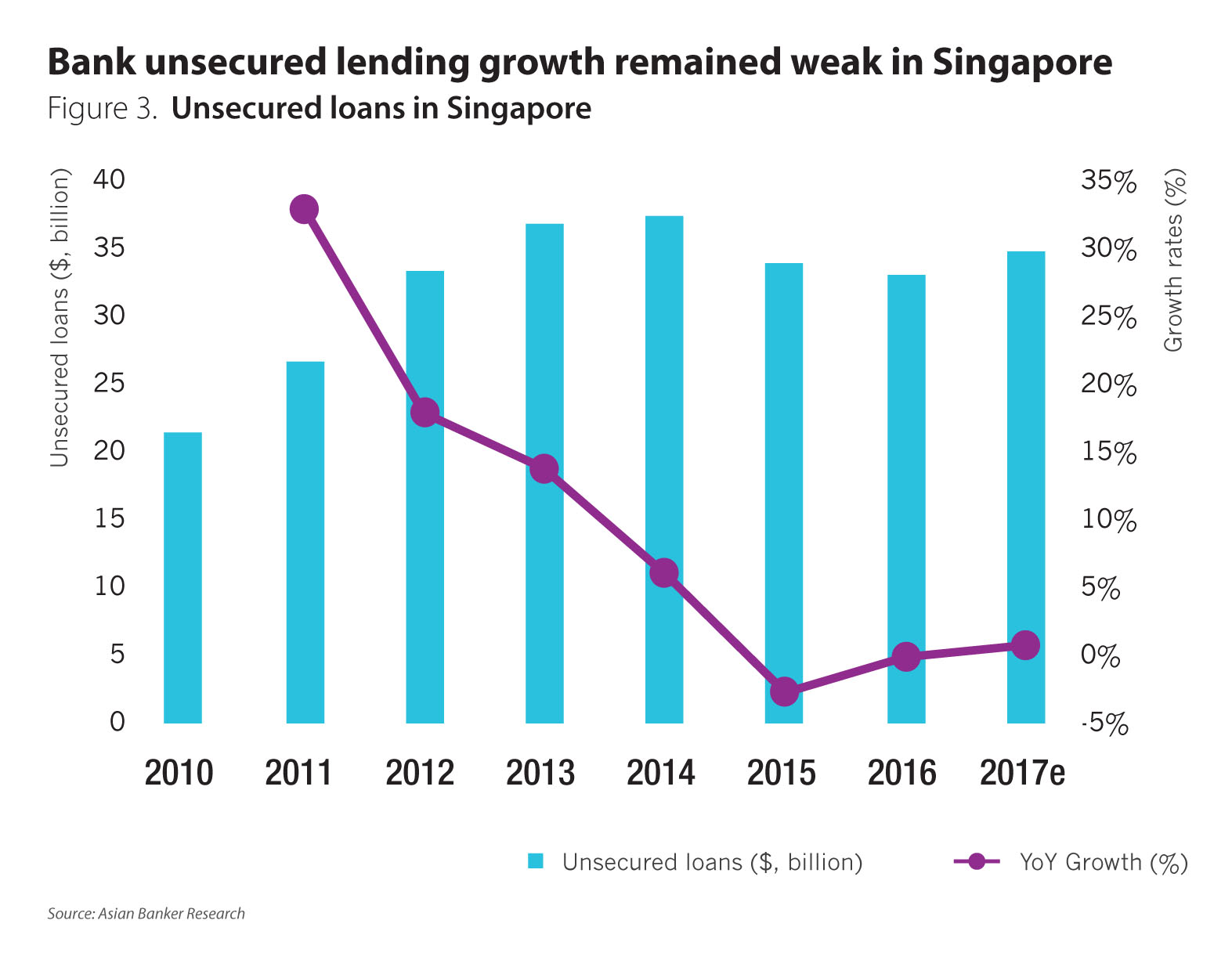

Singapore

During the period of 2010-2013, the bank unsecured loans grew at a CAGR of 21% in Singapore, which led to rising concerns over the personal financial situations of some Singaporeans. The growth has slowed down considerably in the past three years, which can be attributed to the Monetary Authority of Singapore (MAS)’s tightening of unsecured lending standards since the end of 2013. The unsecured loans expanded at a significantly slower growth rate of 6% in 2014, and declined by 2.9% and 0.1% in 2015 and 2016, respectively (Figure 3).

MAS announced amendments to credit cards and unsecured credit rules in September 2013 to help individuals avoid accumulating excessive debt. Banks are not allowed to grant further unsecured credit to someone whose outstanding unsecured debt is more than 12 times his monthly income for three consecutive months.

Borrowers were granted a transition period of 18 months to pay down their existing debts to within the limit. In April 2015, MAS decided to give affected borrowers more time to adjust to the new measures, and the limit on credit cards and other unsecured credit facilities will be implemented in phases from June 2015 to June 2019.

In addition, the repayment assistance scheme (RAS) and debt consolidation plan (DCP) was launched in April 2015 and January 2017 respectively, to help over-indebted borrowers pay off unsecured debts. DCP allows overextended borrowers to consolidate their existing outstanding unsecured loans across multiple financial institutions with just one participating institution, which can simply repayment process and reduce repayment costs for borrowers.

Thailand

The unsecured lending in Thai banking sector registered a growth rate of 10.5% in 2014 after expanding at a CAGR of 22% between 2010 and 2013. The growth rate contracted further to 5.5% in 2015, the first time the unsecured loans failed to expand by double digits. This is expected to remain subdued in 2017 (Figure 4).

Both banks and customers have been cautious on unsecured loans, given the slowdown of economy, high household debt levels, decline in household purchasing power and the deterioration in banks’ credit quality. Meanwhile, some individuals prefer to get personal loans from informal lenders, which also has an adverse impact on bank unsecured loan growth.

The “debt clinic” programme was announced in May 2017 to help relieve the household debt problem. The troubled debtors with multiple creditors can participate in the programme and repay the sourced unsecure loans through Sukhumvit Asset Management (SAM), who will manage the clinic and help turn bad debts into performing assets. The interest rate the restructured debt carries is no more than 7%, which is far below the interest rate banks charge customers on unsecured loans.

The Bank of Thailand is set to announce tighter rules on unsecured consumer loans in August 2017, which aims to keep consumers from overspending. It is expected that there will be restrictions on credit limit and number of credit cards that can be issued to each cardholders.

Predee Daochai, chairman of the Thai Bankers’ Association (TBA), said the amended regulations will improve consumer spending discipline, helping them avert further debt accumulation, and alleviate lenders’ burden in setting aside loan-loss buffers. However, the stricter unsecured lending standards may spur increased growth in the informal loans.

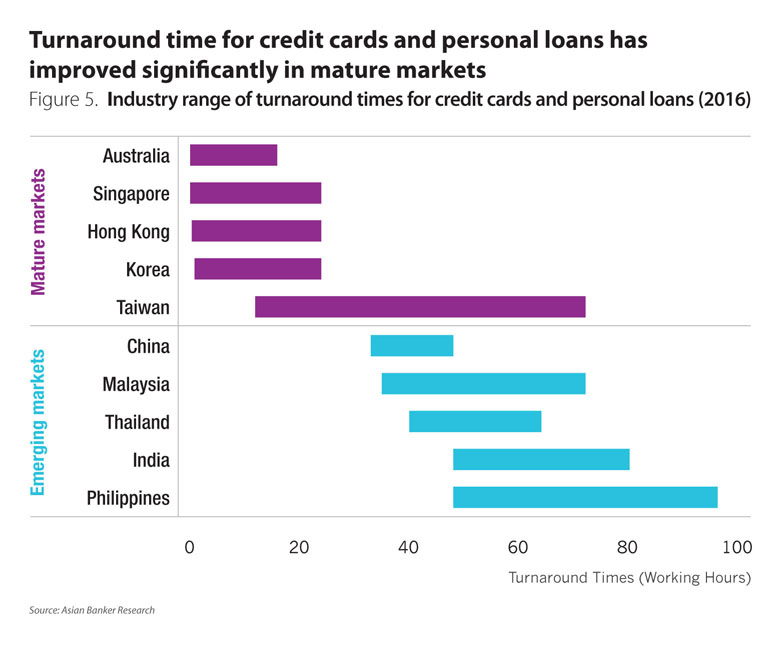

Turnaround times for unsecured loans

In the subdued yet competitive environment, Asia Pacific banks have been working on improving processing time for unsecured loans to meet the growing customer demand and capture a larger share of the unsecured lending market.

Thanks to the growing use of digital technology, banks have made significant improvements in reducing the turnaround times for credit cards and personal loans during the past few years, which resulted in higher process efficiency, increased customer satisfaction and lower cost.

However, there is still disparity between mature and emerging markets. Credit cards and personal loans take longer processing time in emerging markets (Figure 5). Among the banks in these markets we surveyed, turnaround time for credit cards and personal loan ranges from less than one hour to 2.5 days in mature markets, and from 32 hours to four days in emerging markets.

In addition, consumers can get credit cards and personal loans faster than mortgages. The turnaround time for mortgages doubles or triples the time for credit cards and personal loans. Credit cards and personal loans allow for faster approvals, as collateral is not required and less paperwork is involved.

Meanwhile, banks charge higher interest rates on credit cards and personal loans. In the case of mortgage loans, to a great extent, the process is still paper-based and manual, and therefore it takes more time for banks to disburse mortgages. Technology will continue to shorten the turnaround times for both secured loans and unsecured loans.

Unsecured loans offer better profit margins than other segments, due to higher interest rates banks charge borrowers. Thus, the slower unsecured lending growth has adversely influence the retail profitability of banks.

In response, banks are now increasingly simplifying and boosting the business beginning with the application process to provide customers faster turnaround time and compete with new challengers in the market.In addition, being a high-risk business, banks are taking the muted growth as an opportunity to manage household debt accumulation and to closely monitor their loan portfolios.

Going forward, the overall unsecured lending growth in the Asia Pacific region is expected to remain moderate.

All Comments