The rise of cryptocurrencies over the past five years or so has been a heady experience. For entrepreneurs and retail investors, small fortunes have been made from cryptocurrency investing. From the talkfests in Davos in Switzerland to the bitcoin mining factories tucked away in Chinese and Indian cities, to the boardrooms of Manhattan, it’s all been about cryptocurrency. But has it all been a mirage?

On 11 November 2022, the Bahamas-based FTX and its subsidiaries filed for Chapter 11 bankruptcy protection in the United States. FTX, founded in mid-2019, collapsed owing cryptocurrency investors on its platforms billions of dollars. Thousands of retail investors are expected to lose much of their cryptocurrency investments. In addition, high-profile institutional investors including Ontario Teachers’ Pension Plan, Sequoia Capital, Softbank, and Temasek have all written their respective equity investments in FTX down to zero.

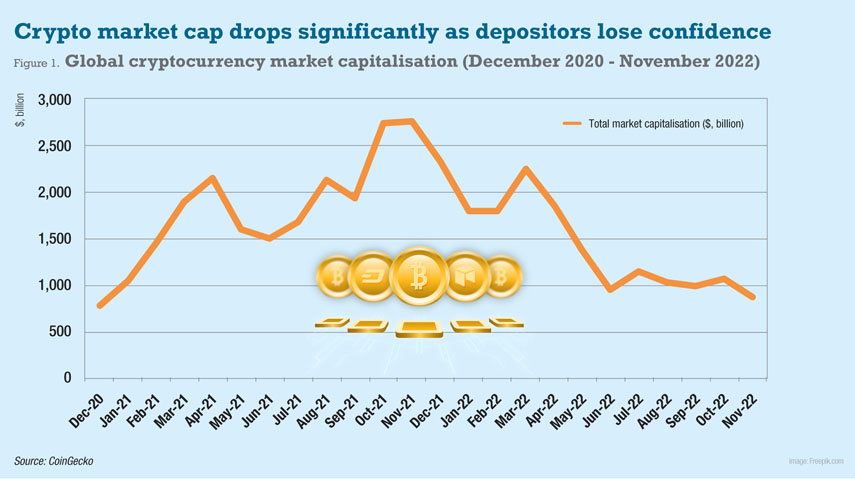

Depositors and investors are all wondering where it all went wrong and what lessons can be learnt.

Start-ups are risky

Start-ups by nature have no established track record or history of operation – profitable or otherwise. Professional investors in start-ups go in with their eyes wide open and accept that a large percentage of start-ups will fail. Perhaps some forgot this in the rush to enter the sector.

The main mitigants to the start-up investment risk are essentially rigorous due diligence and taking a portfolio approach to investing. Whilst the investment losses from an equity investment in FTX will be painful, investors should take these losses in their stride. Not every start-up investment works out.

There is an additional layer of complexity in investing in businesses and industries involving the development and adoption of new technologies. The risks increase with unproven technologies and new industries. These include blockchain applications, metaverse businesses, and non-fungible tokens (NFTs). The failure of a new business to commercialise in these areas may not be readily apparent. This may in some cases lead to fraudulent business practices to keep the venture afloat.

Investing in asset bubbles

FOMO, the fear of missing out, can lead to much handwringing and anxiety. Investors see peers, business colleagues, and friends making small fortunes and are reluctant to miss out. Even when the analysis indicates that the investment opportunity may in fact be too good to be true.

There will have been venture capital investors that declined the opportunity to invest in FTX. They will now be celebrating holding their nerve and not having FOMO. As is usual, we are now seeing start-ups and venture capital investors reassess their due diligence processes and investment appetite.

Dan Bennett, managing director for Australia of Israeli-based venture capital investing group OurCrowd observed that “FTX is another example of hype and market exuberance driving herd confidence. This led many stakeholders to disregard traditional due diligence and red flags particularly in light of FTX’s breakneck growth. FTX with its limited transparency, poor process, lack of board of directors and excessive power resting in the hands of a single individual created a dangerous quagmire.”

Unregulated businesses can be risky

Investing in regulated businesses – for example, financial services, utilities, and healthcare – offers investors a degree of protection. Regulatory requirements will usually lead to robust governance and risk management controls. There is no guarantee that a regulated entity will comply but there is at least a high probability that foundational governance and risk management practices will be in place.

Digital payments, cryptocurrency platforms, and digital currency exchanges are at best lightly regulated and at worst totally unregulated businesses. John Ray III, the new CEO of FTX appointed when the group filed for bankruptcy protection, stated in the first court filing that despite the group having “billions in investments other than cryptocurrency” the main companies “did not keep complete books and records of their investments and activities”. Ray went on to say that never in his career “have I seen such a complete failure of corporate controls”.

Management capability and integrity

Debt and equity markets look closely at the capability and strength of management teams. In the venture capital world, often management - and the vision they pitch - is the only thing the investors are backing. Underpinning this faith in management needs to be a clinical assessment of the capabilities of the founder or founders. This assessment will no doubt be more prominent going forward after the FTX collapse.

Singapore’s deputy prime minister, Lawrence Wong, has highlighted that the country’s national investment company, Temasek Holdings, has suffered “reputational damage” due to its failed investment in FTX. All investors will be reassessing their approach. An assessment of the integrity of management should also be undertaken. Irrespective of whether a business is established or in the start-up phase, integrity and ethics should be not negotiable. It is unfortunate that investors often only find management wanting in hindsight. History is littered with examples of integrity failures from Enron to Madoff and now to FTX and its founder, Sam Bankman-Fried.

Retail investors have a limited ability to assess management capability and integrity. Institutional investors do however get the opportunity to meet management and undertake some level of due diligence before investing funds. Regulators across the globe will be undertaking post mortems to see what more they could have done to have prevented the losses incurred by retail investors.

Assessing the potential for fraud by professional investors will be a critical component of due diligence going forward after FTX. This should involve looking critically at the culture within the business, the management of corporate expenses, and the lifestyle of the founder or founders.

Governance and risk management

One of the notable features of the FTX collapse has been the almost complete absence of any board or organisational governance. As noted above, regulated businesses – even start-ups in regulated industries – will usually have foundational governance and risk management frameworks in place.

Sam Bankman-Fried, was the sole director of FTX and there was little corporate governance oversight of the FTX Group. FTX’s new CEO Ray noted in his court filing that “many of the companies in the FTX Group, especially those organised in Antigua and the Bahamas, did not have appropriate corporate governance. I understand that many entities, for example, never had board meetings”. Ray went on to state that there were, as a result, no financial or risk management controls.

Scott Langdon of KordaMentha, administrator of FTX Australia, emphasised thatBankman-Fried confirmed in his own words that this was a ‘massive failure of oversight of corporate governance’. He also noted that “investigations to date have revealed, amongst other things, no chief financial officer, no risk committee and no chief risk officer.” Langdon stated that this regrettably “has left up to 30,000 Australian customers in a compromised, anxious and uncertain position for the foreseeable future.”

For start-ups, many governance initiatives are not expensive to put in place. Simple foundational initiatives may involve the appointment of independent board directors, holding regular board meetings, establishing an audit and risk committee, and conducting regular internal and external reviews of key business processes. As a business grows, the appointment of a chief risk officer and head of internal audit will also be important.

It is apparent that all start-ups or scale-up businesses seeking significant sums of investor money will now be required to establish and demonstrate sound governance and risk management practices. The collapse of FTX will be another reminder of the importance and value of sound governance and risk management. There are perhaps no new lessons here.

All Comments