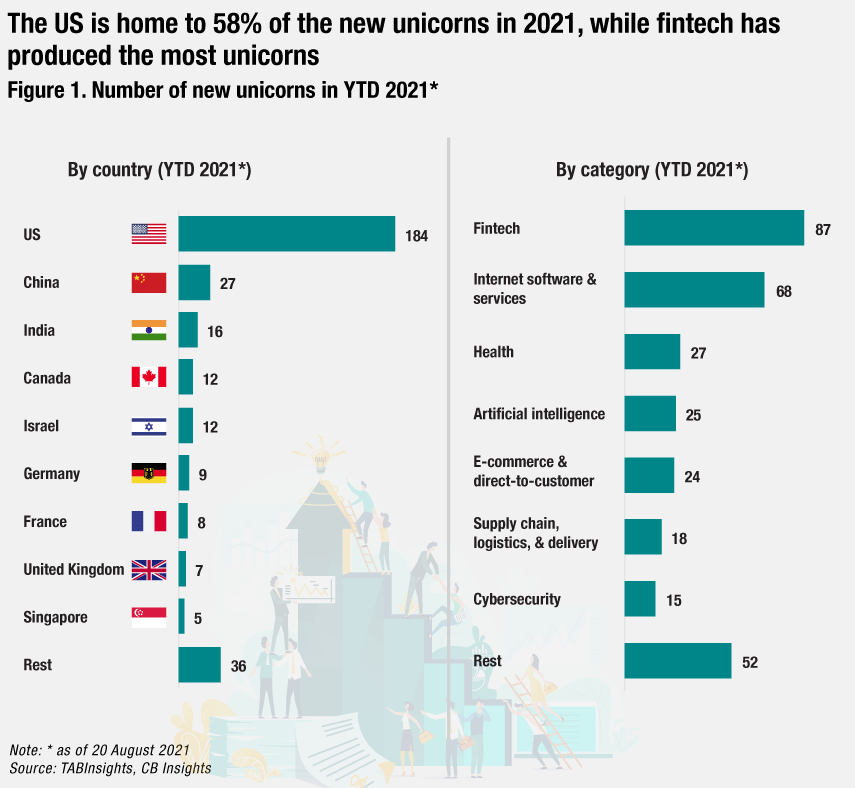

- US companies dominate the list of unicorns, while Indian startups have received more funding amid China’s crackdown on tech companies

- Fintech and internet software and services have produced the most unicorns

- As of 20 August 2021, 38 unicorns are valued at $10 billion or more, according to data from CB Insights

The year 2021 has witnessed an impressive expansion in the number of unicorns, or privately held startup companies valued at $1 billion or more. As of 20 August 2021, 801 unicorns exist around the world and their cumulative valuation amounts to $2.6 trillion, according to CB Insights. These unicorns are based in 41 countries and spread across 215 cities. Out of the 801 unicorn companies, 316 reached unicorn status between 1 January and 20 August 2021.

The venture capital investments in startups are booming this year, which led to a growing number of new unicorns. According to CB Insights, startups globally raised $292.4 billion in the first half of 2021, up by 140% from the same period last year. There were 249 new unicorns created in the first half of 2021, in comparison 2020 only produced a total of 128 new unicorns.

US companies dominate the list of unicorns

The US has the highest number of unicorns at 402 as of 20 August 2021, followed by China (158), India (40), and the UK (31). In the first eight months of 2021, the US has already added 184 new unicorns, which accounted for 58.2% of the 316 new unicorns globally. China only accounted for 8.5% of the 316 new unicorns, although 19.7% of all current unicorns globally are from China. China’s crackdown on tech firms led to a shift in global investment interest towards other markets.

India has benefited the most from China’s crackdown on tech companies as startups in the country have received record inflows of venture capital. This year, India added 16 unicorn companies, including Digit Insurance, Eruditus Executive Education, ShareChat, and Infra.Market. With a valuation of $16.5 billion, online education provider Byju’s surpassed Paytm’s parent company One97 Communications as the most valuable startup in India after raising around $350 million in fresh funding in June 2021. Byju’s is the 14th most valuable unicorn in the world as of 20 August 2021.

Fintech and internet software and services are top producers of unicorns

Fintech and internet software and services have produced the most unicorns. Among the 801 unicorns worldwide, 19.1% of them are engaged in fintech, 16.5% in internet software and services, 10.7% in e-commerce and direct-to-consumer, 8.4% in artificial intelligence, and 7.1% in healthcare. Meanwhile, fintech accounted for 27.5% of the 316 new unicorns added to the list in the first eight months of 2021, followed by internet software and services (21.5%) and healthcare (8.5%).

As of 20 August 2021, 38 startup companies are valued at $10 billion or more, according to CB Insights. China-based Bytedance is the world’s most valuable unicorn company, followed by online payment processing company Stripe and Elon Musk’s SpaceX. Bytedance, the owner of the short-video apps TikTok and Douyin, hit a $140 billion valuation following an investment from Tiger Global in March 2020. The company had 1.9 billion monthly active users across all its platforms at the end of 2020 and its revenue grew by 111% to $34.3 billion in 2020. The valuation of Stripe almost tripled in less than a year to $95 billion after raising $600 million in a funding round in March 2021.

Almost 40 unicorns are valued at $10 billion or more

Swedish payments firm Klarna, US grocery delivery platform Instacart, UK’s challenger bank Revolut and Brazilian challenger bank Nubank are among the highest-valued unicorn companies. Klarna is the highest valued unicorn company in Europe. It reached a $45.6 billion valuation after raising $639 million in June 2021. The valuation of Revolut was increased to $33 billion after it raised $800 million in a new funding round led by SoftBank and Tiger Global in July 2021.

Unicorns exit by either going public or by being acquired. Chinese ride-hailing company Didi, US cryptocurrency exchange Coinbase, and Indonesia-based e-commerce firm Tokopedia are among the unicorns that have exited this year. Some unicorns that have announced plans to go public are Bytedance, Nubank, and One97 Communications. ByteDance plans to list on the Hong Kong Stock Exchange by early next year, but the plan may change due to the rapidly changing regulatory environment. While some unicorns will exit, more are expected to be created before the end of the year, due to the active venture capital market and the growing startup ecosystems.

All Comments