- Alibaba’s Single' Day did not only surpass last year’s sales but also generated higher sales growth

- The company continued to invest on various technologies such as Alibaba Cloud and Alipay to handle and process global sales demand

- Alibaba introduced a “New Retail” model to enhance customer experience and drive sales for its retailers

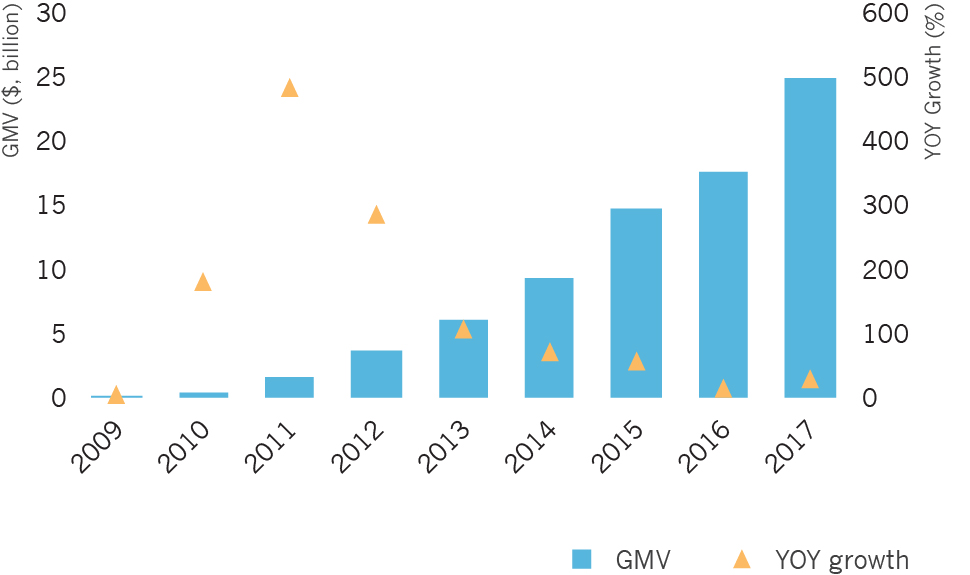

Alibaba’s Singles' Day, an annual 24-hour shopping marathon, has broken its own record once again, registering $25.3 million (RMB168.3 billion) in gross merchandise volume (GMV). This year’s sales showed a 39% growth compared to 24% registered last year (Figure 1). This is a positive sign for the e-commerce giant as critics has been wary of the company’s ability to sustain its sales growth, which has been on a downwards trend after it hit an average of 60% growth from 2013 to 2015.

Singles' Day 2017 recovered from last year’s muted growth

Figure 1. Alibaba's Singles' Day GMV, 2009-2017

Source: Alibaba

This year, Alibaba sold $7 billion worth of goods during the first 30 minutes and surpassed last year’s total GMV after 13 hours. The total orders grew by 23% to 812 million, highlighting Alibaba’s strong capability and infrastructure to process daily sales transactions. Alibaba Cloud, the cloud computing arm and business unit of Alibaba Group, handled 325,000 orders per second at peak; while Alipay, the company’s online payment service provider, managed around 1.5 billion payment transactions – a 41% increase from last year – and processed 256,000 transactions per second at peak. This year also saw the highest record of mobile sales at 90%, reflecting the soaring mobile trend in China.

Daniel Zhang, chief executive officer of Alibaba, emphasised that Singles' Day is about consumer engagement and brand-building. To achieve these objectives and transform physical stores into pop-up smart stores, the company introduced its “New Retail” model, integrating online, offline, logistics and data across a single value chain. This year, Alibaba partnered with 52 shopping malls in bringing 60 pop-up stores across 12 cities in the country. 100,000 stores were also transformed into “smart stores”, featuring new technological capabilities such as facial recognition-powered payment solutions, scan-and-deliver online-to-offline shopping features, and augmented reality beauty tutorials. Such move was proven effective as Alibaba confirmed that each of the 167 merchants generated over $15.1 million (RMB100 million) in sales, 17 merchants exceeded $75 million (RMB500 million), while six merchants had $150.9 million (RMB1 billion) in sales.

Meanwhile, Alibaba’s rival JD.com, for the first time, released the 2017 GMV for its “Singles' Day Period”, which was recorded at $19.14 billion (RMB 127.1 billion). JD.com’s “Singles' Day” is a 12-day event compared to Alibaba’s 24-hour sales period. Although JD.com’s sales pale in comparison to Alibaba’s results, this just shows that the Chinese e-commerce market is becoming more saturated due to stiff competition. It is indeed interesting how Alibaba is transforming its business every year, facing various challenges in the industry. Technology, analytics and customer experience are becoming key differentiating factors in building the future of retail – the same important aspects the financial industry should look at in building the future of finance.

November 11 (11.11) has been an “anti-valentine’s day” in China since the 1990s. In 2009, Jack Ma, founder and CEO of Alibaba, saw this as a commercial opportunity to promote discounts and “Double 11” deals to boost revenue during the lull sales period before the Chinese New Year. Since then, the marketing event has grown into a worldwide phenomenon which Alibaba has trademarked in December 2012.

All Comments