- This is the largest anti-monopoly fine since China's Anti-Monopoly Law came into force in 2008

- The so-called “choose one of two” practice refers to Alibaba’s restriction on merchants from doing business or running promotions on rival platforms

- Market regulators are serious on campaign to curb monopolistic practices and develop the platform economy

The Chinese government is imposing a stiff penalty on Alibaba for violating anti-monopoly law. It fined Alibaba a total of RMB 18.2 billion ($2.8 billion). The fine is 4% of Alibaba’s 2019 domestic sales in China that reached RMB 455.7 billion ($69.8 billion).

Largest anti-monopoly fine in China

The $2.8 billion fine is the largest since China's Anti-Monopoly Law came into force in 2008. In 2015, China’s National Development and Reform Commission imposed a fine on Qualcomm totalling RMB 6.088 billion ($975 million). The penalty was 8% of the American chip company’s revenue in 2013.

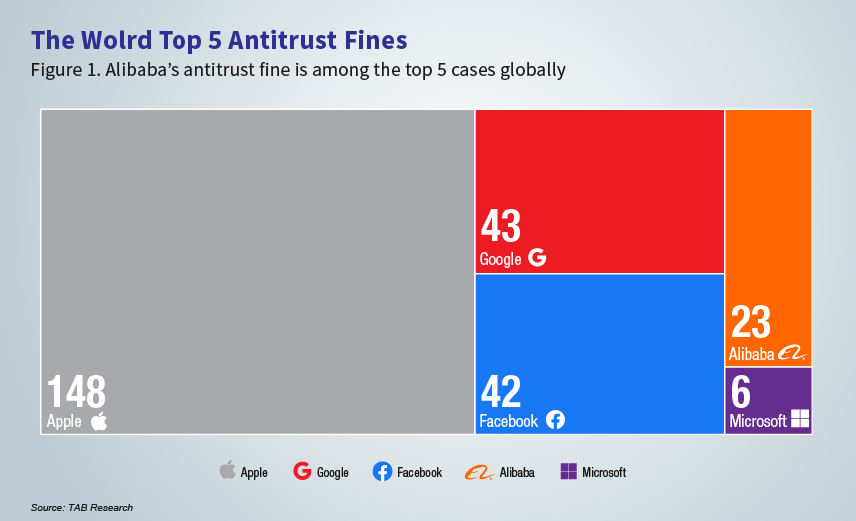

Even on a global scale, the fine against Alibaba ranks among the top. In 2016, the European Union sued Apple and forced it to pay a EUR 14.8 billion ($17.7 billion) fine. The case is still on appeal. In 2018, EU regulators imposed a fine of EUR 4.34 billion ($5.2 billion) on Google for using the Android operating system to shield competitors. In 2019, the US Federal Trade Commission fined Facebook $5 billion for violating consumer privacy. In addition, the Commission and a coalition of Attorneys General from 48 states and territories are filing two antitrust lawsuits against Facebook.

“Choose one of two” policy limits competition

The Anti-Monopoly Law of the People's Republic of China empowers market regulators to impose administrative penalties on erring companies or it supports legal entities or individuals to request civil penalties on erring companies by lawsuit.

The two forms complement each other and jointly maintain the order of market competition. The investigation focused on the so-called “choose one of two” practice that refers to Alibaba’s restriction on merchants from doing business or running promotions on rival platforms. It has always been controversial in the online retail market. As early as 2015, JD.com reported Tmall platform’s requirements on merchants to “choose one of two” and formally filed a lawsuit in 2017, seeking RMB 1 billion ($153 million) in damages. Vipshop and Pinduoduo later started the litigant requests as well.

As a matter of fact, due to the difficulty in obtaining evidence and the lack of identification standards, it is difficult to effectively curb and crackdown on anti-monopolistic behaviour through civil litigation.

However, it is different this time. It took only four months for the SAMR to finish its investigation on Alibaba's alleged monopolistic practices. Moreover, the investigation provides clear guidance on some of the specific issues under the anti-monopoly law, setting the tone for the follow-up regulation.

Promote competition and develop the platform economy

Since last year, President Xi has mentioned the importance of a healthy and sustainable platform economy on several occasions. The development of platform economy has evolved to be the strategic planning under China’s “dual-circulation” economy.

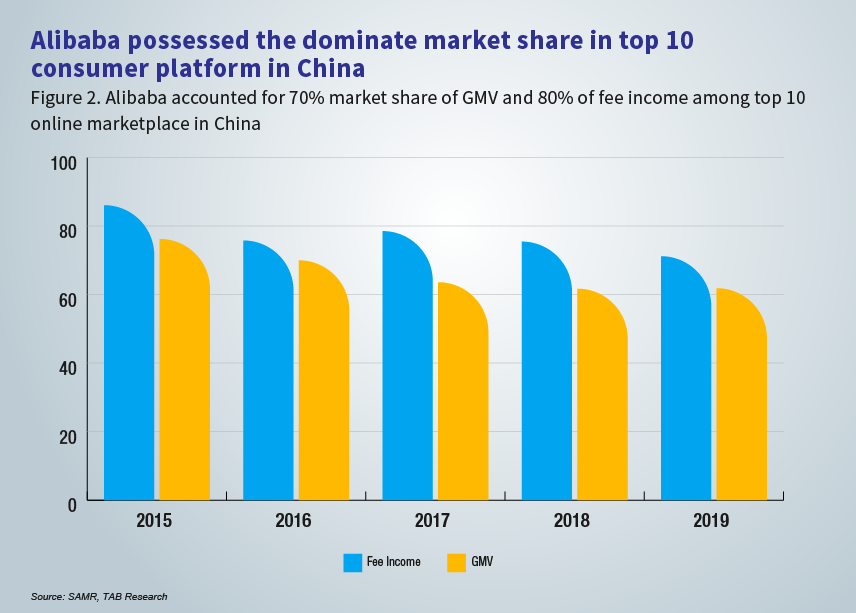

During the investigation, Alibaba once challenged its position of monopoly. SAMR addressed that by disclosing the market share of the company for both gross merchandise value (GMV) and fee income among top 10 online marketplaces in China since 2015. The data showed that the company accounted for around 70% GMV and 80% of fee income in the sector.

On 10 April, Alibaba issued a press release indicating that the company has no objection to the decision made by SAMR and will further have compliance and CSR in place in their day to day operation.

The antitrust investigation on Alibaba would only be a beginning or a signal for more actions on the compliance operation, data governance, privacy protection, and risk prevention of various platforms in the future.

Recently, the People's Bank of China and other financial management departments jointly interviewed Ant Group, Alibaba’s financial technology arm. They responded to set up a financial holding company as a whole to bring all financial businesses under supervision. Alibaba stated as well that they will accept the penalty and will comply with SAMR’s determination.

All Comments