- The antitrust penalty of RMB 18.228 billion ($2.782 billion) dragged the group’s profit down to a record-breaking low

- Regulations and IPO suspension are posing uncertainties to Ant Group

- Alibaba faces intensified competition from other e-commerce platforms

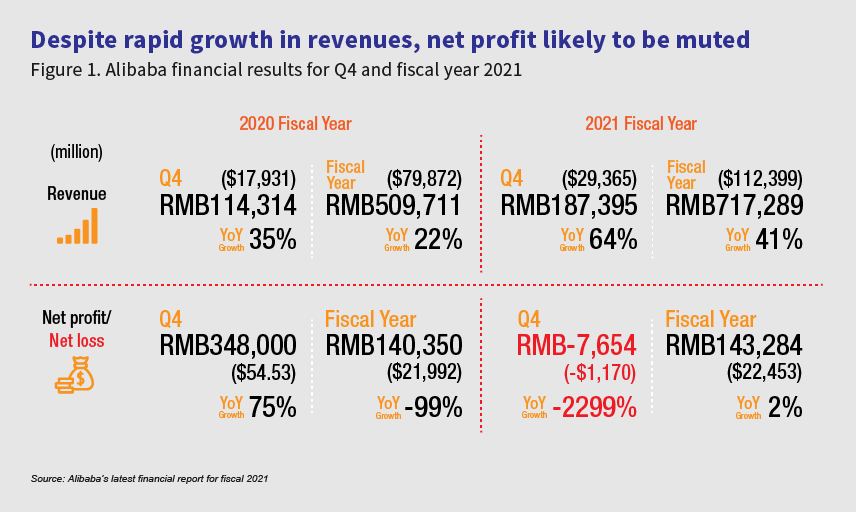

Alibaba posted RMB 717.289 billion ($111.47 billion) in revenues in fiscal year 2021 (1 April 2020 to 31 March 2021) due largely to the growth in consumer business. Alibaba’s RMB 187.395 billion ($29.36 billion) revenue for the quarter ended 31 March 2021 was 64% higher than the RMB 114.314 billion ($17.93 billion) revenue in the same period of the previous year.

"We remain very excited about the growth of the consumer economy driven by the accelerated development of digitisation in all aspects of life and work in China," said Yong Zhang, CEO at Alibaba. “We will continue to focus on customer experience and value creation through innovation as we pursue our mission of making it easy to do business anywhere in the digital age."

Alibaba faced quarterly loss after antitrust penalty

Despite the 64% growth in Q4 revenues, Alibaba registered a net loss of RMB 7.654 billion ($1.17 billion) after being penalised RMB18.228 billion ($2.782 billion) for breaking anti-monopoly laws in March. However, the company ended its fiscal year on a positive note with a net profit of RMB 143.284 billion ($22.45 billion), up 2% from RMB140.35 billion ($21.99 billion) in the previous year.

This was the first time that Alibaba faced a quarterly loss since it went public in 2014. Excluding penalty, the group would end with a net income of RMB 26.216 billion ($4.1 billion) based on non-generally accepted accounting principles (non-GAAP) and a year-on-year (YoY) growth of 18% for the quarter.

Regulations and IPO suspension posing uncertainties to Ant Group

Alibaba owns 33% share of Ant Group which takes the leading position in China’s internet finance industry. Ant Group provides financing for Alibaba’s consumers and it is one of the main revenue contributors of the company. Ant Group brought RMB 7.182 billion ($1.123 billion) investees’ profits in Q4 and RMB 19.693 billion ($3.08 billion) investees’ profits for the fiscal year 2021.

Ant Group’s profit rose 50% to RMB 21.8 billion ($3.41 billion) for the quarter ended 31 December 2020 but has not disclosed data for the latest quarter ended 31 March 2021. Tightened regulations would very much likely limit Ant’s earnings growth and its IPO evaluation.

In November 2020, Ant Group’s IPO in Shanghai and Hong Kong, the largest IPO in history with total market capitalisation of RMB 2 trillion ($312.8 billion), was called off. Ant is still under internal restructuring to meet regulation standards in lending business and financial product offerings. On 25 May, two asset-backed security (ABS), ‘Ant credit pay’ and ‘Ant cash now’ issuances were suspended according to Shanghai Stock Exchange (SSE). Ant credit pay’s feature is similar to virtual credit cards via Alipay, Alibaba’s payment tool. Ant cash now provides short-term consumer loans via Alipay. The two ABS issuances amounted to RMB 18 billion ($2.82 billion) of which RMB 8 billion ($1.25 billion) is for Ant credit pay while RMB 10 billion ($1.57 billion) is for Ant cash now.

Competition heats up among e-commerce platforms

The competition in China’s e-commerce market has intensified. Alibaba reported that its annual active consumers in China’s retail market had climbed to 811 million, up by 3.2 million in the first quarter of 2021.

Pingduoduo said its annual active buyers reached 823 million as of the first quarter of 2021, an increase of 35.4 million. It has overtaken Alibaba as the largest e-commerce operator in China. Pingduoduo has grown aggressively with revenue of RMB 22.167 billion ($3.49 billion) and a YoY growth rate of 239% in the first quarter of 2021.

ByteDance, Kuaishou Technology, and other newly emerging tech firms were expanding their social commerce businesses. In addition, platforms such as Meituan and Didi have also invested in the community e-commerce business, posing a threat to the growth of Alibaba’s e-commerce platform, Taobao.

Jack Ma, the founder of Alibaba, hasn’t shown up recently. His latest appearance to the public was at the Rural Teacher Award ceremony held by Jack Ma Foundation in January. He has not given any comment on Alibaba’s business. “Innovation must come at a price, and our generation must take responsibility for it,” Ma said during a speech at Bund Summit in Shanghai in October 2020. “The essence of finance is credit management. We must get rid of the pawnshop mentality of today's finance and rely on the development of a credit system,” he added.

Alibaba was affected by the tightened regulations and the stalled IPO of Ant Group. However, it remains one of the dominant businesses in the world and continues to play an indispensable role in China. Uncertainties remain but the whole world wants to see how Jack Ma and his empire of Ali will step out of the cumbers.

All Comments