- Al Rajhi Bank is the largest and strongest Islamic bank in the world

- The average asset growth of Islamic banks accelerated amid the pandemic

- Overall, Islamic banks in Saudi Arabia achieved the highest average strength score

Saudi Arabia-based Al Rajhi Bank has retained its top spot as the largest and the strongest Islamic bank based on the ranking of the 100 largest Islamic banks in the world. Its total assets expanded by 13% year-on-year (YoY) to reach $111 billion at the end of the first half of financial year 2020 (1H FY2020).

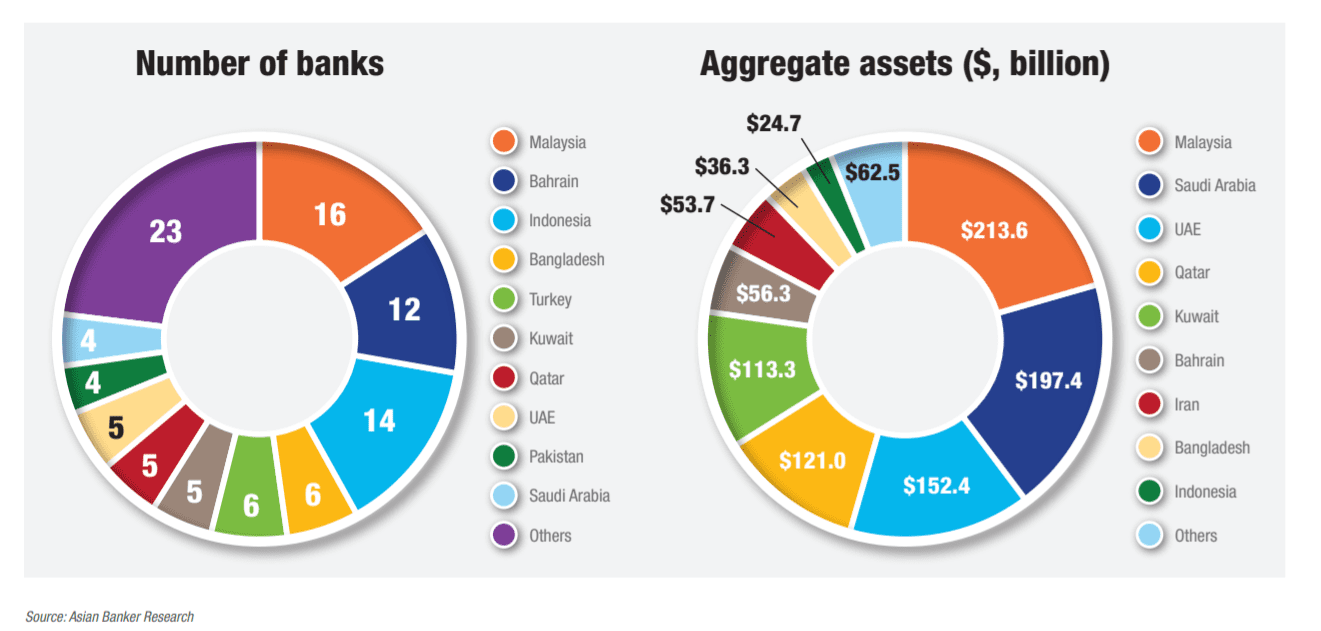

This year’s evaluation covers banks from 23 countries, and financial information in 1H FY2020 was collated and incorporated into the assessment of how Islamic banks performed during the COVID-19 pandemic. At the aggregate level, total assets of Islamic banks on the list stood at $1.03 trillion, compared to $903.9 billion in the previous year’s evaluation, which was based on data in FY 2018.

The aggregate total assets of Islamic banks from Malaysia, Saudi Arabia, UAE, Kuwait and Qatar account for 77% of the total assets of the 100 largest Islamic banks. Bahrain and Indonesia combined have 7.9% share of total bank assets, although there are 26 Islamic banks from these two countries.

Top 100 Islamic banks: Saudi Arabian Islamic banks are the strongest while Malaysia holds the largest combined Islamic bank assets

Figure 1. Breakdown of the world’s 100 largest Islamic banks

Accelerated growth and weaker profitability

The average asset growth of Islamic banks listed accelerated from 8.7% YoY at the end of 1H FY2019 to 13% YoY at the end of 1H FY2020, which is higher than the average asset growth recorded by the 200 largest banks in the Middle East and Africa at 10.9% YoY and the 500 largest banks in Asia Pacific at 10.3% YoY.

Dubai Islamic Bank places second in the ranking of the largest Islamic banks. The bank posted a strong asset growth of 29% after its acquisition of Noor Bank, this is 20% higher than that of Kuwait Finance House, the third largest Islamic bank. Maybank Islamic, the largest Islamic bank in Asia, places fourth in the ranking, while Faisal Islamic Bank of Egypt is the largest in Africa, with total assets of $6.8 billion.

The overall profitability of Islamic banks weakened amid the pandemic. Average return on assets (ROA) stood at 1.1% in 1H FY2020, lower than 1.5% in 1H FY2019, and cost to income ratio was up slightly from 41.3% to 41.5%. Aggregate net profit was down from $6.7 billion in 1H FY2019 to $5.3 billion in 1H FY2020

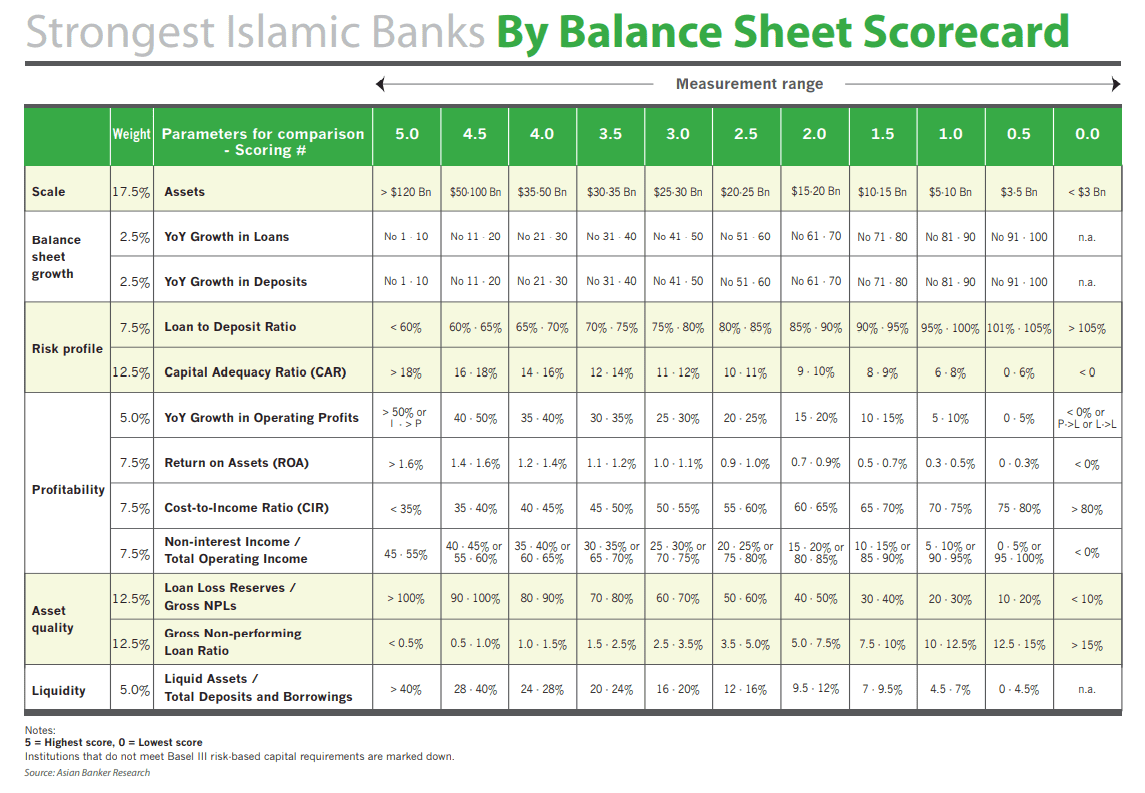

The Islamic Bank scorecard allows institutions to reflect on the factors that underpin the strength of their balance sheets

Figure 1: Criteria of the Islamic Bank scorecard

Islamic banks in Saudi Arabia are the strongest

Overall, Islamic banks in Saudi Arabia achieved the highest average strength score at 3.74 out of 5, followed by Qatar (3.60), Kuwait (3.30) and Pakistan (3.27). This is based on a detailed and transparent scorecard that evaluates Islamic banks and financial holding companies (banks) on six areas of balance sheet financial performance; namely the ability to scale, balance sheet growth, risk profile, profitability, asset quality and liquidity.

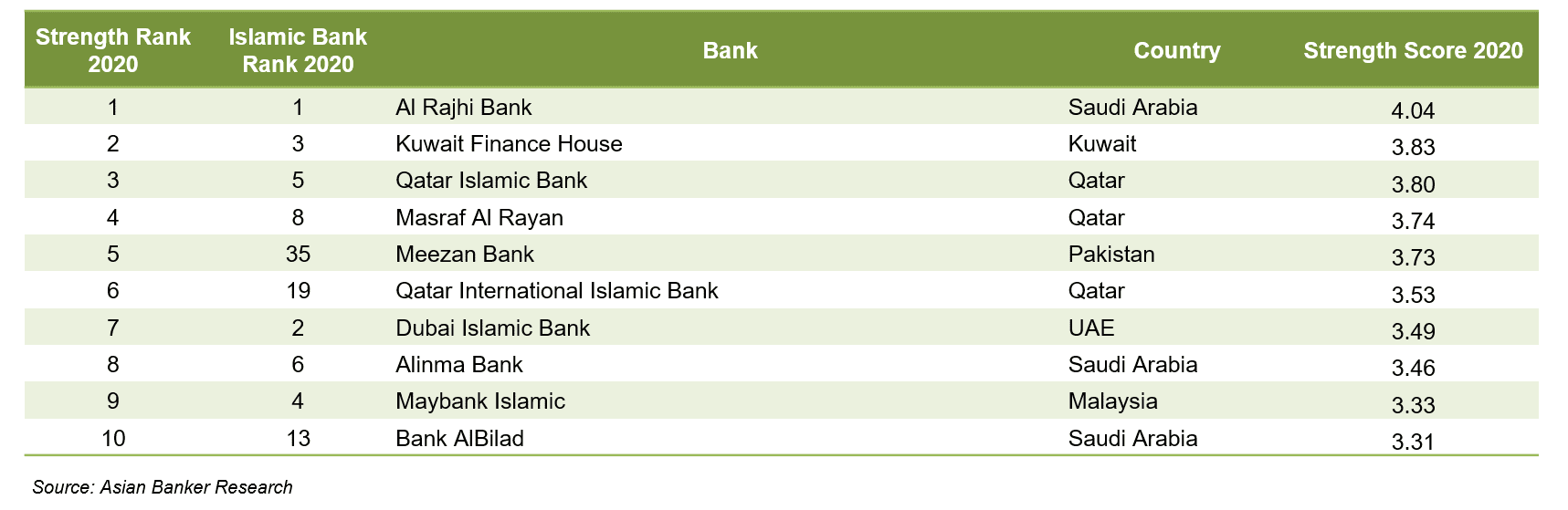

The strength score of Al Rajhi Bank dropped from 4.16 in the previous year’s evaluation to 4.05 in 1H 2020, due to the increase in gross non-performing loan (NPL) ratio from 0.85% to 1.02% and loan to deposit ratio from 79% to 82%, along with the drop in profit growth. Nevertheless, the bank still maintained healthy asset quality and robust capitalisation, and recorded a high ROA of 2.4% and a low cost to income ratio of 33%.

Al Rajhi Bank has retained its top spot as the strongest Islamic bank

Figure 3: Top 10 Strongest Islamic Banks By Balance Sheet

Meezan Bank from Pakistan is the strongest Islamic bank in Asia. The operating profit of the bank surged 66% in 1H FY2020 thanks to higher volume of earning assets portfolio and higher underlying rates. The bank recorded a lower cost to income ratio from 47% to 40% and a higher ROA from 1.5% to 2.0%. Meanwhile, the bank maintained strong levels of capitalisation and liquidity.

Mergers and acquisitions (M&As) involving Islamic banks have continued to be active. For example, Qatar’s Barwa Bank merged with International Bank of Qatar in 2019 and was rebranded as Dukhan Bank. Masraf Al Rayan, the second largest Islamic bank in Qatar, will acquire Al Khalij Commercial Bank. In Asia, Bank BNI Syariah and Bank Syariah Mandiri will merge with Bank BRI Syariah to form Bank Syariah Indonesia, that will have total assets of around $15 billion. In addition to the M&A between domestic banks, there are also cross-border M&As, such as the proposed acquisition of Bahrain’s Ahli United Bank by Kuwait Finance House. Going forward, it’s expected that the Islamic banking industry will maintain its robust asset growth momentum, driven by the strong and growing demand for Islamic financial services.

All Comments