Governments, central banks, and private companies in Asia are actively working together to strengthen payment integration, connectivity, and interoperability. Initiatives such as ASEAN’s Regional Payment Connectivity (RPC) cooperation and payments policy framework are driving cross-border payment innovations, paving the way for faster, cheaper, and more inclusive transactions. Additionally, private sector players like Swift, Visa, Mastercard, and Alipay are introducing new technologies and platforms to support seamless cross-border payments in the region.

Central banks of five of the 10 members of the Association of Southeast Asian Nations (ASEAN), namely Bank Indonesia, Bank Negara Malaysia, Bangko Sentral ng Pilipinas, Monetary Authority of Singapore, and Bank of Thailand signed a memorandum of understanding (MOU) on cooperation in RPC in November 2022 to enhance cross-border payments.

The initiative aims to support economic recovery, promote inclusive growth, and facilitate trade, investment, remittance, and tourism activities in the region, and covers transaction modes such as quick response (QR) code and instant or fast payments.

The RPC initiative aligns with the G20’s Roadmap for Enhancing Cross-Border Payments by 2025. It also supports ASEAN’s goal of connected payment systems, fostering stronger regional economic ties. The implementation of RPC could expand to include other countries in the region and potentially partner countries outside the region.

To achieve greater payment integration in ASEAN, the Working Committee on Payment and Settlement Systems, under the aegis of the ASEAN Economic Community, completed implementing policy guidelines for cross-border real-time retail payments in October 2020.

Countries in ASEAN are also advancing the interoperability of standardised QR code payments and introducing real-time remittance systems. Singapore-Thailand, Laos-Thailand, and Cambodia-Thailand linkages have been implemented to facilitate instant, low-cost fund transfers. The integration of common guidelines and standards like ISO 20022 and QR codes streamlines processes, enhances transparency and security, and shortens clearing and settlement cycles.

The rapid growth of instant domestic instant payment systems has revolutionised the landscape of financial transactions in Southeast Asia with the emergence of PromptPay, operated by National ITMX in Thailand; National Payment Corporation of Vietnam by State Bank of Vietnam; PayNow by Banking Computer System, a subsidiary of NETS in Singapore; DuitNow by PayNet in Malaysia; BI-FAST by Bank Indonesia; and Bakong by National Bank of Cambodia.

One key aspect of this transformation is the growing linkages among these systems that are paving the way for faster and more efficient cross-border retail and business-to-business payments, fostering greater economic integration in the region.

Thailand, for instance, has been actively integrating its PromptPay system with payment systems in other countries. As of now, Thailand has established around six cross-border payment linkages with countries like Cambodia, Indonesia, Japan, Malaysia, Singapore and Vietnam. These linkages enable instant, low-cost fund transfers between the connected countries.

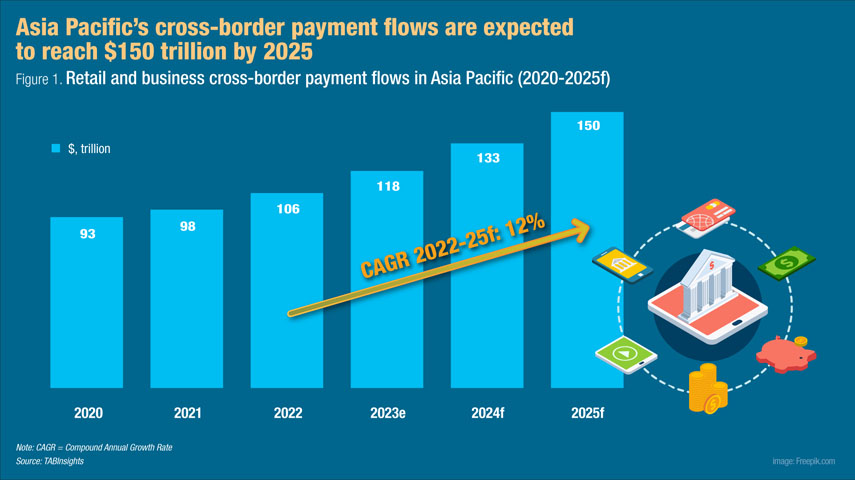

Cross-border payments and foreign exchange (FX) services in Asia hold significant potential to banks and fintech payment service providers. According to data from TABInsights, the research and consulting arm of The Asian Banker, cross-border payment flows in Asia amounted to $97.8 trillion in 2021 and are expected to grow at a compound annual rate of 12% between 2022 and 2025 to hit $150 trillion.

Cross-border payments and FX transactions in the region accounted for about 35% of global total transaction and over 40% of total global revenue, according to Mckinsey and Company. And traditional banks are losing market share to fintech players such as AirWallex, Aspire, Currencyxe, Revolut and Wise, and includes newcomers like Statrys and many more innovative payment startups looking to serve the estimated $300 billion internet economy and 10 million internet businesses in Southeast Asia alone.

They are focused on the emerging underserved segments such as small and medium-sized enterprises (SME) and leverage new digital capabilities and operating models to deliver faster and more cost-effective solutions as compared to the correspondent banking model dominated by the incumbent banks.

The digitalisation of the financial sectors in ASEAN is accelerating the convergence and integration of payment systems. Players are adopting digital and banking frameworks based on open programming application interface (API), exploring distributed ledger technology (DLT), and shifting from physical to digital payment instruments.

Private sector players like Mastercard, Ripple, R3, Swift and Visa are all actively involved in migrating the sector to common standards and technologies. Alipay+, B2B Connect, Mastercard’s cross-border payment solutions, Swift Go, and Visa Direct offer alternatives for faster and more efficient cross-border transactions that will benefit from the integration of instant payment systems.

In addition, the Bank for International Settlements (BIS) Nexus project aims to create multilateral linkages with instant payment systems. Nexus seeks to work with central banks and governments to facilitate cross-border payments by connecting different domestic instant payment systems.

It noted the challenge of the existing bilateral arrangements that will increase in complexity exponentially as integration with more countries increases, hence the need for greater standardisation, harmonisation and interoperability as early as possible in the design, implementation and operationalisation of payment systems.

The next phase of the project, led by the BIS Innovation Hub in Singapore, involves collaborating with ASEAN central banks and their payment system operators to implement the Nexus blueprint. The goal is to establish a global implementation that goes beyond regional integration. By fostering collaboration between public and private sector players, the BIS Nexus project aims to create a robust and interconnected network of instant payment systems, enhancing the speed, transparency, and cost-effectiveness of cross-border transactions in Asia and beyond.

Swift is also enabling and facilitating the industry’s move to the ISO 20022 messaging standards by 2022, while Nexus aims to connect multiple instant payment systems using a standardised and multilateral approach.

Global payment giants Visa and Mastercard are leveraging blockchain technology to improve cross-border payments, and Alipay+ offers a unified QR code-based payment solution across multiple countries and currencies.

Current state of payment integration in Asia

Wanna Noparbhorn, the managing director of National ITMX that operates the PromptPay instant payment system in Thailand, highlighted the establishment of linkages with regional instant payment systems. She said: “We have successfully established linkages with instant payment systems in several countries across the region, including Singapore’s Fast and Secure Transfers (FAST) and Malaysia’s DuitNow.”

National ITMX and PromptPay have established cross-border linkages with six countries—Cambodia, Indonesia, Japan, Malaysia, Singapore and Vietnam—believed to be the highest number of cross-border instant payment linkages in the world. This has significantly contributed to seamless fund transfers and financial connectivity in Asia.

Despite the achievements, Noparbhorn acknowledged the challenges that hinder comprehensive payment integration in the region. Regulatory compliance, technical interoperability, and the adoption of standardised protocols remain key hurdles, she said, adding: “Overcoming these hurdles requires continued collaboration and cooperation among various stakeholders in the payment ecosystem.”

Sharon Toh, head of ASEAN at Swift, reported that the payments market in ASEAN is growing and becoming increasingly digital. The participation in e-commerce during the pandemic has led to the popularity of online and e-wallets.

According to Accenture, she said, digital payments have surged, exceeding $707 billion in 2021 and projected to reach $1.169 trillion by 2025. Toh stressed the importance of interoperability between different payment modes and infrastructures, saying: “Swift’s global network of more than 11,500 financial institutions and corporations is continually enhanced with a focus on interoperability.”

Deepan Dagur, head of Visa Direct for Asia Pacific at Visa, emphasised the significant progress Visa has made to facilitate payment integration in Asia, saying: “Under Visa’s leadership in Asia Pacific, we have achieved tremendous advancements in payment integration, leveraging solutions such as Visa Direct and Visa B2B Connect.”

These solutions have helped to enable secure and efficient cross-border transactions, taking advantage of standardisation and bilateral correspondent banking relationships. Dagur also acknowledged the challenges that persist in the payment landscape, particularly in improving the speed, cost-effectiveness, and user experience of cross-border payments.

Lawrence Chan, Group CEO of NETS, said that through its subsidiary Banking Computer System, NETS is the operator of choice supporting the national cross-border payment corridors led by the Association of Banks (Singapore) and the Monetary Authority of Singapore.

The two corridors are with Thailand’s PromptPay through National ITMX and India’s Unified Payments Interface through National Payments Corporation of India. As a result, consumers in Singapore can make person-to-person transfers directly to and from bank accounts in Thailand and India.

NETS has also collaborated with its counterparts in Thailand, Malaysia and China to establish bilateral arrangements for Singapore consumers to use their banking apps to pay via QR codes when travelling in these countries. Likewise, visitors from these four countries will enjoy similar conveniences in Singapore.

Role of central banks and regulators

Toh highlighted the progressive initiatives by regulators in ASEAN to make real-time payments easier for customers, commenting: “Across many ASEAN countries, we’re seeing progressive initiatives from regulators to make real-time payments easier for end-customers and people outside the banked ecosystem.”

Regulators and central banks are collaborating to implement cross-border payment linkages and initiatives to facilitate low-cost cross-border payments and drive intra-region trade through QR code payment systems.

Swift’s adoption of ISO 20022 for cross-border payments and reporting (CPBR+) on 20 March 2023 aims to provide a common language for payments worldwide. This adoption helps overcome barriers arising from different market systems speaking different languages. Through ISO 20022, financial institutions are expected to be able to achieve greater operational efficiency, improved data analytics, and enhanced reconciliation and visibility on cash flows and positions.

Noparbhorn emphasised the crucial role of central banks and regulators in facilitating collaboration and standardisation, stressing: “Central banks and regulators play a vital role in establishing a conducive environment for payment integration by providing clear guidelines and regulatory frameworks.”

National ITMX actively engages with central banks and regulators to ensure compliance, promote interoperability, and foster trust among participating institutions.

Noparbhorn also highlighted the role of the Asian Payment Network (APN) in promoting collaboration among payment infrastructure providers. APN facilitates the signing of MOU between providers, including National ITMX, to achieve payment integration by 2025. The MOU establishes linkages and standardises payment processes, enhancing cross-border payment integration in Asia.

Dagur emphasised: “Central banks and regulators play a crucial role in facilitating collaboration and standardisation among industry stakeholders, which is fundamental to driving cross-border payment integration.” He said Visa aims to collaborate with central banks to create secure and standardised solutions in areas like digital currencies.

Chan believes that central banks and regulators play a vital role in promoting cross-border payment integration. Key initiatives include establishing regulatory frameworks, encouraging collaboration, developing common standards, and promoting technological innovation.

Emerging technologies in the future of payment integration

Dagur reflected on the transformative potential of technologies like blockchain and digital currencies in shaping the future of payment integration. Visa is actively exploring the applications of blockchain and digital currencies, particularly fiat-backed stablecoins, to enhance stability and security in cross-border transactions. Despite volatility challenges, Visa aims to provide stable and secure solutions for reliable cross-border payments.

Noparbhorn concurred, saying: “Emerging technologies have the potential to revolutionise cross-border payment systems and enhance transaction efficiency.” However, she emphasised the need for careful evaluation of feasibility and efficiency before adopting blockchain and digital currencies for cross-border transactions.

National ITMX actively explores the possibilities offered by emerging technologies to enhance its payment infrastructure. By leveraging API and adopting a hybrid approach combining new technologies with existing systems on the supply side, National ITMX also strives for ongoing integration in payments infrastructure.

Toh believes that emerging digital technologies, such as mobile wallets, QR payments, and biometric authentication, are crucial for developing instant and seamless online payment solutions. She also notes the interest in central bank digital currencies (CBDC) globally.

Swift works closely with the financial community to enable cross-border use of CBDC and overcome the challenge of different technologies and protocols. Through successful tests, Swift has developed a solution for CBDC to move between DLT-based and fiat-based systems, enabling seamless exchanges.

Dagur commented: “We are aware of the hurdles that persist in the payment landscape. These challenges include the need to improve the speed, cost-effectiveness, and user experience of cross-border payments. Legacy technology stacks within some banks can make seamless integration a challenge, which is a key area that needs to be resolved as we progress payment systems in the region.”

Ensuring security and fraud prevention in cross-border payments

Chan reports that NETS takes comprehensive measures to implement security and anti-fraud systems to protect cross-border payment transactions. It verifies the authenticity and security of foreign QR codes, conducts thorough know-your-customer (KYC) procedures for Singapore-based merchants, and maintains strong governance, rules, and dispute resolution mechanisms to protect consumers and businesses.

National ITMX shares the same dedication to ensuring security and preventing fraud in cross-border payment systems. Noparbhorn said the company implements robust security measures, compliance frameworks, and cybersecurity protocols. Through its central front registry powered by artificial intelligence (AI) and predictive analytics, National ITMX proactively detects and prevents fraudulent activities. Collaboration with stakeholders, including central banks and regulators, is crucial in combatting fraud and enhancing security.

Dagur said Visa prioritises security and fraud prevention in cross-border payment systems. It allocates substantial resources to cybersecurity, maintains a team of cyber specialists, and operates cyber fusion centres across continents. Using advanced technologies like real-time screening, monitoring, and AI-powered pattern recognition, Visa identifies suspicious activities and potential fraud. Collaboration with stakeholders and adherence to regulatory frameworks enhance their security measures.

Swift is a highly secure and reliable payment network that implements various measures to ensure security in cross-border payment systems. It guarantees message delivery with high network and system availability, data encryption, track audits and authentication, and detects intrusions to maintain data confidentiality and integrity.

Swift’s customer security programme assists financial institutions in evaluating and attesting their security measures, while payment controls and AI-powered anomaly detection contribute to fraud prevention and a more secure payments experience.

Future of payment integration in Asia

To drive further payment integration in Asia, NETS is focused on first enhancing domestic offerings in Singapore before expanding cross-border operations to support economic growth and integration. Chan shared that NETS will continue to support Singapore’s vision for payment integration by leveraging its strong infrastructure, partnerships and expertise.

National ITMX envisions expanding its payment infrastructure beyond Thailand and establishing strong connections with other countries in the region. It aims to support seamless cross-border transactions and enhance payment integration in Asia. Noparbhorn believes collaboration with stakeholders, standardisation, and the role of payment infrastructure providers such as National ITMX will be emphasised to achieve comprehensive integration by 2025.

Dagur expanded on Visa’s plans to provide a next-generation money movement solution that prioritises speed, consistency, and global reach. It aims to offer innovative solutions for various customer groups and promote collaboration with banks and fintech partners. Through these partnerships and a network approach, Visa seeks to make cross-border payments more seamless and user-friendly, fostering economic growth, financial inclusion, and integration in Asia.

Swift has been working towards enabling instant and frictionless transactions globally. It has launched initiatives like Swift Go, Payment Pre-validation, and ISO 20022 adoption for cross-border payments and reporting. Swift’s innovative API-based CBDC connector enables interconnectivity between digital currencies, linking ‘digital islands’ and advancing instant, frictionless cross-border payments. Their network and collaborations contribute to linking ASEAN with the rest of the world.

The collaboration between governments, central banks, and private sector players in Asia is crucial for achieving the goal of regional payment integration. By keeping approaches and options open and flexible, authorities can navigate the deluge of private-public initiatives to formulate a robust and interconnected payment ecosystem.

All Comments