Globalisation, digital finance, and the need for better access to finance and improved control are transforming how central banks design and issue currency. In this development, central banks have, since the mid-2010s, been exploring possibilities of using central bank digital currencies (CBDC) as the mean of convergence. However, central banks are not alone in this race, but central banks keep ignoring private market initiatives, which have gained much traction, given certain risks.

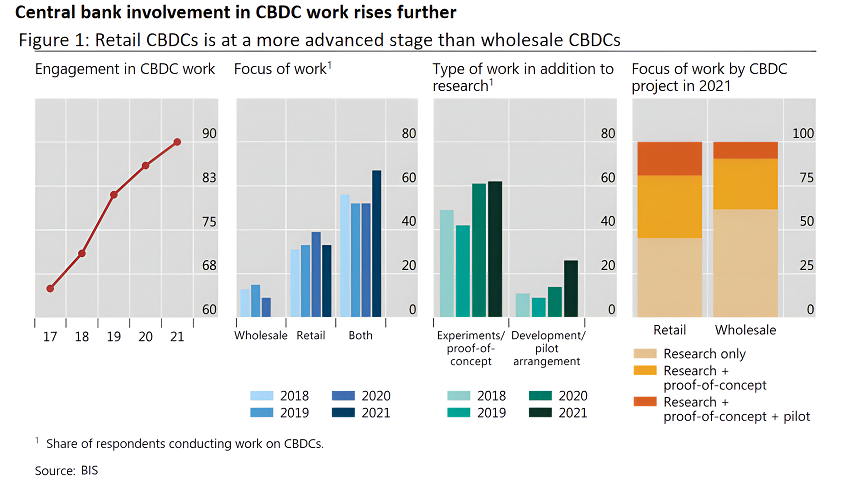

A chief task of any central bank is to design and issue the currency the country needs to facilitate exchanges, trade, and transactions. Over the years, several different designs have been implemented, e.g., currency union and more widely spread fiat currency, and some designs have been disallowed, e.g., gold-back currency. Currently, 72 central banks are designing CBDC to address several important needs, as reported by the Bank of International Settlements (BIS).

According to BIS, CBDC would be a digital banknote that can be used by individuals to pay for goods and peer-to-peer transactions, i.e., retail CBDC. CBDC can also be used between financial institutions to settle trades, i.e., wholesale CBDC.

At the user level, the majority of central banks focus on retail CBDC with the objective of improving access to financial services. Already, in the retail space, users have the ability to use their mobile devices and, by embedded identity authentication services, make real-time payments via numerous local and global service providers predominantly found in the private sector. However, such setups tend to exclude customers having difficulties accessing financial services, to begin with, and in developing economies, this is more of a problem, hence the importance of financial inclusion.

At the system level, a majority of central banks are working via interoperability projects to achieve the objective of higher payment efficiency. Interoperability can be reached in two ways first, the co-existence of both commercial banks and central banks in a digital currency environment, i.e., the two-tier design, and second, via efficient payment systems interfaces.

At the policy level, the control of currency made possible through transaction monitoring are features that central banks already realize through various regulations executed by financial institutions, including commercial banks. According to the latest BIS survey on CBDC development, more than 70% of central banks prefer a two-tiered as it provides the opportunity to embed several processes in the current setup of intermediary banks. The processes include onboarding of clients that includes know-your-customer (KYC), anti-money laundering/combating the financing of terrorism (AML/CFT) procedures), and handling of retail payments.

At the market level, the development of digital payment methods, cryptocurrencies, e.g., bitcoin and stablecoins, is perceived as a risk by central banks. As per the BIS report, about 70% of central banks maintain their position against such private market initiatives since they expect such payment methods to offer limited transparency and cause jurisdictional conflicts.

Under the umbrella term digital finance and encouraged by technological development, e.g., blockchain, about one-third of central banks around the world envisage opportunities with CBDC. CBDC can support the fulfilment of central banks’ chief task of designing and issuing currency.

With the development of efficient payment methods, the market can expect more use cases of CBDC. So far, a few central banks have launched in either the retail space or both the retail space and wholesale space.

Central banks seem to follow a common approach for exploring, designing, and issuing CBDC, and the above-mentioned considerations, including financial inclusions, payment efficiency, and the considerations of private market initiatives, will be slightly different between countries.

All Comments